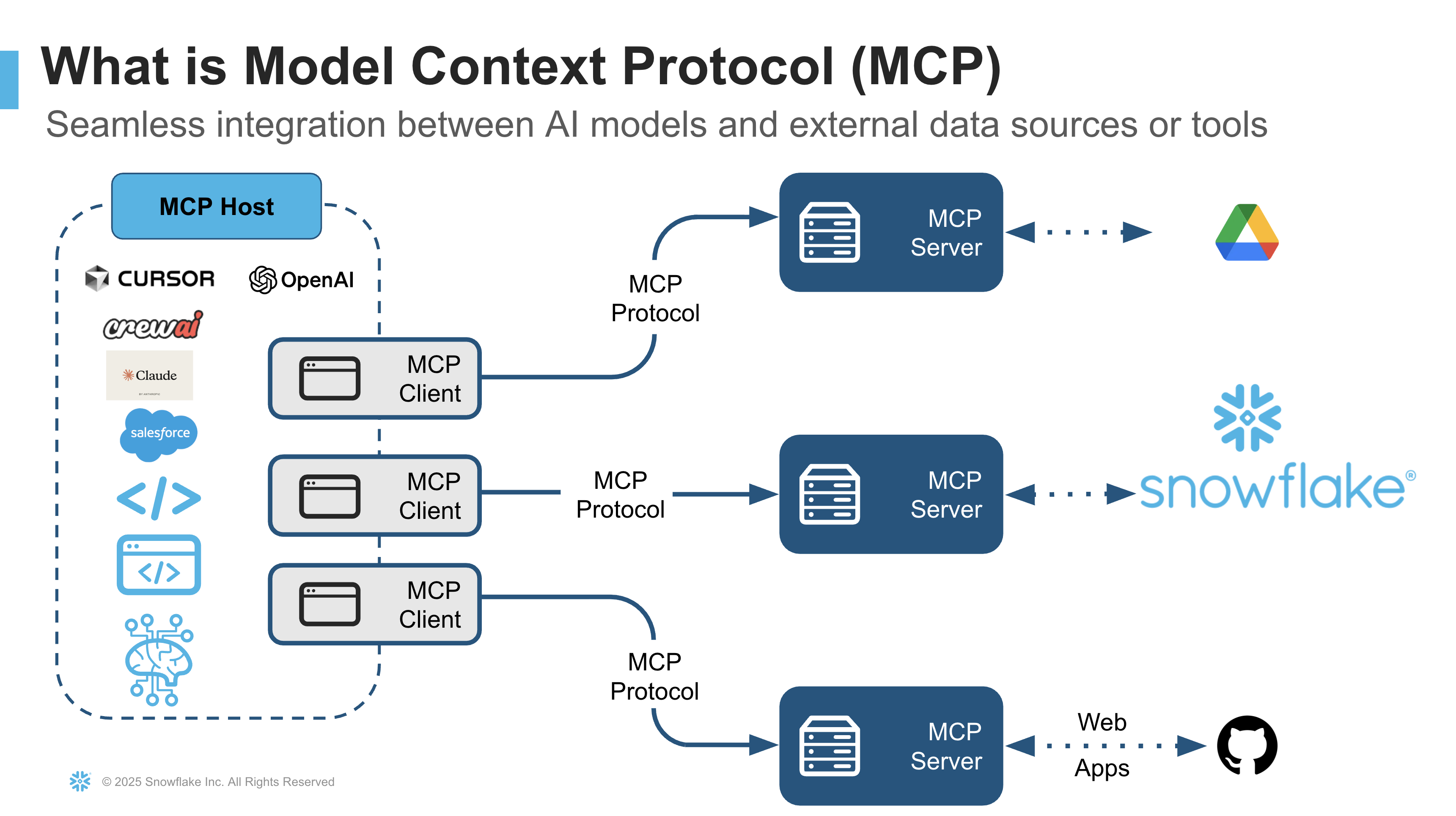

The Snowflake MCP Server allows AI agents to securely retrieve data from Snowflake accounts without needing to deploy separate infrastructure. MCP clients discover and invoke tools, and retrieve data required for the application. The Snowflake MCP Server includes Cortex Analyst and Cortex Search as tools on the standards-based interface. It is now available with Model Context Protocol (MCP) so that AI Agents can discover and invoke tools (Cortex Analyst, Cortex Search) via a unified and standard based interface.

Top 3 Benefits

- Governed By Design: Enforce the same trusted governance policies, from role-based access to masking, for the MCP server as you do for your data.

- Reduced Integration: With the MCP Server, integration happens once. Any compatible agent can then connect without new development, accelerating adoption and reducing maintenance costs.

- Extensible Framework: Provide agents with out-of-the-box secure access to structured and unstructured data. You can refine the tools to improve how agents interact with your data.

Why It Matters

MCP Server on Snowflake simplifies the application architecture and eliminates the need for custom integrations. Enterprises can expedite delivery of generative AI applications with richer insights on a standards based architecture and a robust governance model with the Snowflake AI data cloud.

NOTE: Snowflake MCP Server is in Public Preview as of October 2025.

Prerequisites

- Access to a Snowflake account with ACCOUNTADMIN role. If you do not have access to an account, create a free Snowflake trial account.

- Access to Cursor.

What You Will Learn

- How to create building blocks for Snowflake MCP Server that can intelligently respond to questions by reasoning over data

- How to configure Cursor to interact with Snowflake MCP Server

What You Will Build

A Snowflake MCP Server that intelligently responds to questions by reasoning over data from within Cursor.

Create Objects

- Clone GitHub repo.

- In Snowsight, create a SQL Worksheet and open setup.sql to execute all statements in order from top to bottom.

Create Personal Access Token

Create a Personal Access Token (PAT) for your role and make a note/local copy of it. (You will need to paste it later.)

Create Cortex Search Service

This tool allows the agent to search and retrieve information from unstructured text data, such as customer support tickets, Slack conversations, or contracts. It leverages Cortex Search to index and query these text "chunks," enabling the agent to perform Retrieval Augmented Generation (RAG).

- In Snowsight, on the left hand navigation menu, select AI & ML » Cortex Search

- On the top right, click on Create

- Role and Warehouse: ACCOUNTADMIN | DASH_WH_S

- Database and Schema: DASH_MCP_DB.DATA

- Name: Support_Tickets

- Select data to be indexed: select FACT_SUPPORT_TICKETS table

- Select a search column: select DESCRIPTION

- Select attribute column(s): select CATEGORY, SUBCATEGORY, PRIORITY, CHANNEL, STATUS, SATISFACTION_SCORE

- Select columns to include in the service: Select all

- Configure your Search Service: Keep default values and select DASH_WH_S for "Warehouse for indexing"

Create Snowflake MCP Server

To create the Snowflake MCP server, run the following in the same SQL worksheet.

create or replace mcp server dash_mcp_server from specification

$$

tools:

- name: "Support Tickets Search Service"

identifier: "dash_mcp_db.data.support_tickets"

type: "CORTEX_SEARCH_SERVICE_QUERY"

description: "A tool that performs keyword and vector search over support tickets and call transcripts."

title: "Support Tickets"

$$;

Now let's try this out in Cursor, but note that you should be able to use other clients like CrewAI, Claude by Anthropic, Devin by Cognition, and Agentforce by Salesforce.

Cursor

In Cursor, open or create mcp.json located at the root of your project and add the following. NOTE: Replace and with your values.

{

"mcpServers": {

"Snowflake": {

"url": "https://<YOUR-ORG-YOUR-ACCOUNT>.snowflakecomputing.com/api/v2/databases/dash_mcp_db/schemas/data/mcp-servers/dash_mcp_server",

"headers": {

"Authorization": "Bearer <YOUR-PAT-TOKEN>"

}

}

}

}

Then, select Cursor -> Settings -> Cursor Settings -> MCP (or Tools & MCP) and you should see Snowflake under Installed Servers.

NOTE: If it continues to say "Loading tools" running the following curl command to test your connection.

curl -X POST "https://<YOUR-ORG-YOUR-ACCOUNT>.snowflakecomputing.com/api/v2/databases/dash_mcp_db/schemas/data/mcp-servers/dash_mcp_server" \

--header 'Content-Type: application/json' \

--header 'Accept: application/json' \

--header "Authorization: Bearer <YOUR-PAT-TOKEN>" \

--data '{

"jsonrpc": "2.0",

"id": 12345,

"method": "tools/list",

"params": {}

}'

Q&A

Assuming you're able to see the tool Support_Tickets_Search_Service under newly installed Snowflake MCP server, let's chat! Start a new chat in Cursor and set your mcp.json as context to ask the following questions.

Q1. Can you summarize the overall sentiments based on the support calls?

In a few moments, you should see a response similar to this.

NOTE: The response may not be the exact same.

Based on my analysis of the support tickets data, here's a comprehensive summary of the overall sentiments from support calls:

Overall Sentiment Summary

The support call data reveals three distinct sentiment categories with varying customer experiences:

🟢 Positive Sentiments (~35-40% of feedback)

Key Characteristics:

High praise for agent professionalism: Customers specifically commend agents who are "professional, knowledgeable, and genuinely cared about helping"

Problem resolution satisfaction: Quick resolution of complex issues (e.g., account balance discrepancies, wire transfer problems)

Communication excellence: Agents keeping customers informed throughout the process

Persistence and dedication: Support staff staying on calls until complete resolution

Representative feedback:

"Outstanding customer care!"

"They investigated thoroughly and found the missing deposit"

"The agent stayed on the line until everything was resolved"

🔴 Negative Sentiments (~30-35% of feedback)

Major Pain Points:

Long wait times: Customers reporting being on hold for over an hour

Multiple transfers: Frustration with being transferred 3+ times without resolution

Agent unprofessionalism: Reports of rude, dismissive, or annoyed agents

Account issues: Unexpected account freezes causing public embarrassment

Poor communication: Agents unable to explain problems or rushing through explanations

Representative feedback:

"Completely unprofessional"

"I've been transferred three times already and still no resolution"

"The embarrassment was terrible and the agent couldn't explain why it happened"

🟡 Neutral/Informational (~25-30% of feedback)

Characteristics:

Routine inquiries: Questions about interest rates, account tiers, balance requirements

Straightforward transactions: Basic information requests handled efficiently

No strong emotional response: Professional but unremarkable interactions

Representative feedback:

"Everything was straightforward"

"The agent provided the information and explained the different account tiers"

Key Insights

Bimodal Distribution: Customer sentiment tends to be either very positive or very negative, with fewer neutral experiences

Agent Training Impact: The difference between positive and negative experiences often comes down to individual agent skills and approach

Process Issues: System problems (account access, multiple transfers) contribute significantly to negative sentiment

Resolution Speed: Quick, thorough problem-solving generates the strongest positive feedback

Recommendations

Focus on reducing wait times and transfer frequency

Enhance agent training on communication and problem-solving skills

Improve system reliability to prevent unexpected account issues

Standardize the excellent service that generates positive feedback across all interactions

The data suggests a support organization with high potential but inconsistent execution, where exceptional service exists alongside significant operational challenges.

Q2. Which support categories would benefit most from automated responses based on transcript analysis?

In a few moments, you should see a response similar to this.

NOTE: The response may not be the exact same.

Based on my comprehensive analysis of the support call transcripts, here are the support categories that would benefit most from automated responses:

🟢 High Automation Potential (70-90% automation success rate)

1. Account Balance & Transaction Inquiries

Evidence: Multiple calls with identical patterns: "I called to check my current account balance and recent transaction history. The agent verified my identity and provided the requested information."

Automation Strategy:

Automated identity verification via PIN/security questions

Real-time balance lookup from banking systems

Transaction history delivery via voice or SMS

Estimated Impact: Reduces call volume by 15-20%

2. Interest Rates & Product Information

Evidence: "I'm calling to inquire about the current interest rates for savings accounts. The agent provided the information and explained the different account tiers."

Automation Strategy:

Dynamic rate lookup from current rate tables

Automated explanation of account tiers and requirements

Minimum balance and fee information delivery

Estimated Impact: Reduces call volume by 10-15%

3. Basic Account Information

Evidence: Frequent requests for routing numbers, branch locations, hours

Automation Strategy:

Location-based branch finder

Automated routing number delivery after identity verification

Business hours and contact information

Estimated Impact: Reduces call volume by 8-12%

4. Standard Check Orders

Evidence: "I need to order checks for my checking account. The representative took my order and confirmed the delivery address."

Automation Strategy:

Automated order processing with address confirmation

Style selection through interactive menu

Delivery timeline and cost information

Estimated Impact: Reduces call volume by 5-8%

🟡 Medium Automation Potential (40-60% automation success rate)

5. Lost/Stolen Card Replacement

Evidence: "I called to report a lost debit card and request a replacement. The agent immediately canceled the old card and ordered a new one."

Automation Strategy:

Automated card cancellation after identity verification

Replacement card ordering with address confirmation

Temporary card number provision for immediate use

Escalation: Complex fraud cases require human intervention

6. Simple Fee Inquiries

Evidence: Complaints about unexpected fees, but also straightforward fee structure questions

Automation Strategy:

Automated fee schedule delivery

Account-specific fee history

Escalation: Fee disputes require human review

🔴 Low Automation Potential (Requires Human Intervention)

7. Transaction Disputes & Fraud

Evidence: "Thank you so much for your help today! I was really worried about the unauthorized transaction, but you walked me through the dispute process clearly."

Why Human Required:

Complex investigation needed

Emotional support required

Legal compliance requirements

Multi-step verification processes

Congratulations! You've successfully created a Snowflake MCP Server that intelligently responds to questions by reasoning over data from within Cursor.

What You Learned

- How to create building blocks for Snowflake MCP Server that can intelligently respond to questions by reasoning over data

- How to configure Cursor to interact with Snowflake MCP Server