Data silos have been a significant problem in the Financial Services industry. During the Global Financial Crisis of 2008, firms without a Single Version of the Truth (SVOT) made multi-million dollar trading decisions without visibility into their risk, exposure, and the cascading impact of their positions. These data silos led to multi-billion dollar losses and bankruptcies.

In this guide, you'll build a Financial Services Asset Management demo in Snowflake that scales to handle 3 billion synthetic trades while providing real-time cash and profit/loss calculations. You'll learn how to leverage Snowflake's unique architecture to scale compute resources up and down as needed, create a dashboard for monitoring positions, and implement DevOps practices like zero-copy cloning and time travel.

What You'll Learn

- How to query free stock market history data instantly without copying or moving data

- Creating synthetic traders and billions of trades using Python and SQL

- Scaling compute resources up and down to optimize performance and cost

- Implementing cluster keys and auto-clustering for performance optimization

- Creating interactive dashboards with filters for business users

- Using DevOps features like zero-copy cloning and time travel

What You'll Build

A complete Financial Services Asset Management demo with:

- A database of 3 billion synthetic trades

- Real-time position, cash, and profit/loss calculations

- An interactive dashboard for monitoring trading positions

- DevOps capabilities for testing and rollback

This is powered by four SQL Worksheets and a Python Function:

What You'll Need

- Access to a Snowflake account (a free trial on Standard Edition will suffice)

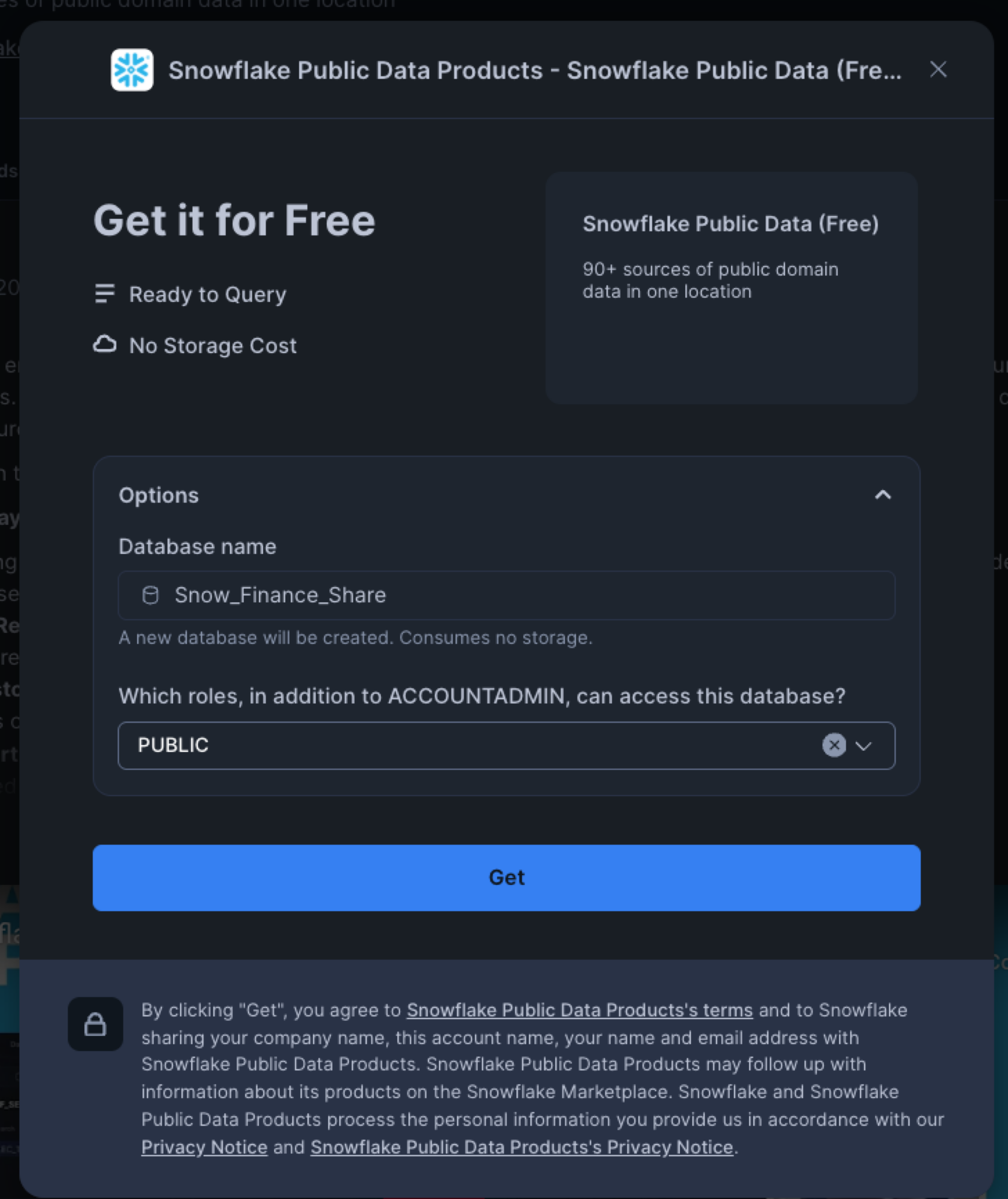

Mount a Free Data Share

First, we need to mount a free data share containing financial market data:

- Log into your Snowflake account

- Navigate to the Marketplace

- Search for "Snowflake Public Data (Free)"

- Click "Get" to mount this free share as a database named "Snow_Finance_Share"

- Grant the PUBLIC role access to the database

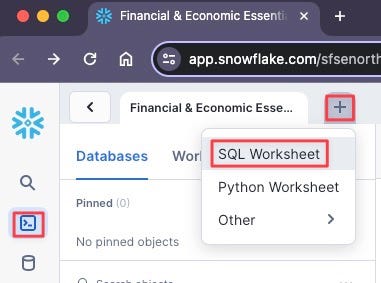

Create the Setup Worksheet

Now we'll create our first SQL worksheet to set up the environment:

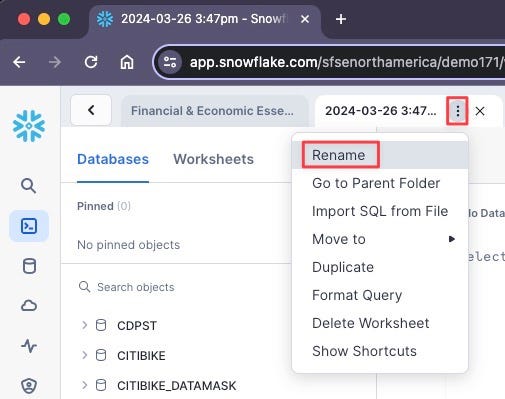

- Navigate to Worksheets Mode

- Click the Plus Symbol (+), then SQL Worksheet

- Click the Ellipsis and rename the script to "Finserv 10 Setup"

- Copy and paste the following SQL:

-- Create role

use role accountadmin;

create role if not exists finservam_admin comment = 'Ownership of finservam database and demo';

-- Create compute

create warehouse if not exists finservam_devops_wh

with warehouse_size = 'xsmall' auto_suspend = 120 initially_suspended = true comment = 'Financial Services DevOps Compute';

create warehouse if not exists xsmall_const_wh

with warehouse_size = 'xsmall' auto_suspend = 60 initially_suspended = true comment = 'Constant so should always be XS and not resized';

-- Permissions are granular to meet your requirements

create database if not exists finservam comment = 'Financial Service Asset Management';

grant ownership on database finservam to role finservam_admin;

grant ownership on schema finservam.public to role finservam_admin;

grant ownership on warehouse finservam_devops_wh to role finservam_admin;

grant ownership on warehouse xsmall_const_wh to role sysadmin;

grant monitor, operate, usage on warehouse xsmall_const_wh to role finservam_admin;

grant role finservam_admin to role sysadmin;

use schema finservam.public;

create schema if not exists transform comment = 'for silver layer transformations in a medallion architecture. generally not meant for end user visibility';

grant ownership on schema transform to role finservam_admin;

use schema finservam.public;

use warehouse finservam_devops_wh;

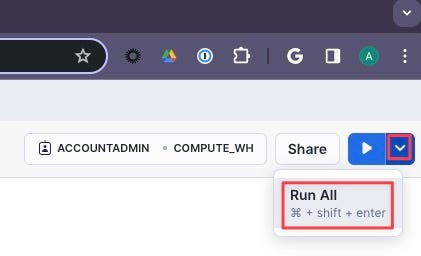

- Click the Inverted Chevron to Run All

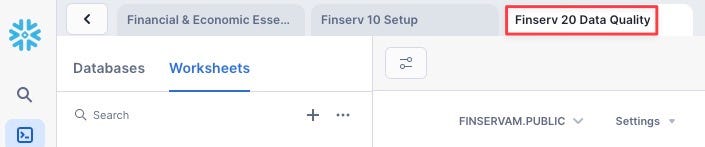

Create the "Finserv 20 Data Quality" Worksheet

- Create a new SQL Worksheet named "Finserv 20 Data Quality"

- Copy and paste the following SQL:

-- setup

use role finservam_admin;

use warehouse finservam_devops_wh;

use schema finservam.public;

-- Verify Data Marketplace Share

select *

from Snow_Finance_Share.PUBLIC_DATA_FREE.stock_price_timeseries

where ticker = 'SNOW' and variable = 'post-market_close' order by date;

-- transform.exclude_symbol

create or replace table transform.exclude_symbol

comment = 'Exclude Symbols that have ever had a price less than 1 cent or greater than $4500'

as

select distinct ticker symbol

from Snow_Finance_Share.PUBLIC_DATA_FREE.stock_price_timeseries

where

variable = 'post-market_close'

and primary_exchange_name in ('NASDAQ CAPITAL MARKET', 'NEW YORK STOCK EXCHANGE')

and (value < .01 or value > 4500)

order by 1;

-- stock_history

create or replace transient table finservam.public.stock_history

comment = 'Daily closing prices for NASDAQ & NYSE'

as

select

ticker symbol,

date,

value close,

primary_exchange_code exchange,

asset_class

from Snow_Finance_Share.PUBLIC_DATA_FREE.stock_price_timeseries k

left outer join transform.exclude_symbol e on e.symbol = k.ticker

where

variable = 'post-market_close'

and primary_exchange_name in ('NASDAQ CAPITAL MARKET', 'NEW YORK STOCK EXCHANGE')

order by symbol, date;

--add comment on column

comment on column stock_history.close is 'security price at the end of the financial market business day';

Create Python Faker Function

Next, we'll create a Python function to generate synthetic trader data:

-- Python fake function used to generate synthetic traders

create or replace function fake_py(locale varchar,provider varchar,parameters variant)

returns variant

language python

volatile

runtime_version = '3.9'

packages = ('faker','simplejson')

handler = 'fake'

as

$$

import simplejson as json

from faker import Faker

def fake(locale,provider,parameters):

if type(parameters).__name__=='sqlNullWrapper':

parameters = {}

fake = Faker(locale=locale)

return json.loads(json.dumps(fake.format(formatter=provider,**parameters), default=str))

$$;

-- Verify English & Chinese fake names

select fake_py('en_US','name',null)::varchar as FAKE_NAME from table(generator(rowcount => 10));

select fake_py('zh_CN','name',null)::varchar as FAKE_NAME from table(generator(rowcount => 10));

Run the entire worksheet to create the necessary tables and functions.

Create the Trades Worksheet

- Create a new SQL Worksheet named "Finserv 30 Billions of Trades"

- Copy and paste the following SQL to set variables and create synthetic portfolio managers:

-- Set Variables (which we can use to scale up and down) and fake Portfolio Managers (PM)

-- Set context

use role finservam_admin; use warehouse finservam_devops_wh; use schema finservam.public;

-- Set Variables

set limit_trader = 300; //on xxlarge will create ~3B trades

set limit_pm = $limit_trader / 10; //Every Portfolio Manager (PM) will have about 10 traders reporting to her.

-- Portfolio Manager (PM)

-- Unique number generator

create or replace sequence pm_id;

create or replace transient table pm

comment = 'PM is the Portfolio Manager who manages the traders' as

select

fake_py('en_UK','name',null)::varchar as PM,

pm_id.nextval id

from table(generator(rowcount => $limit_pm));

Create Synthetic Traders

Next, add the code to create synthetic traders:

-- Create Synthetic Traders

-- We don't need a transaction but we demo it

begin transaction;

create or replace transient table trader

comment = 'Trader with their Portfolio Manager (PM) and trader authorized buying power' as

with cte as

(

select

fake_py('en_US','name',null)::varchar as trader,

uniform(1, $limit_pm, random()) PM_id, //random function to assign a PM to a trader

uniform(500, 3500, random())::number buying_power //how much a trader can buy per day

from table(generator(rowcount => $limit_trader))

)

select

t.trader,

pm.pm,

t.buying_power

from cte t

inner join pm on t.pm_id = pm.id

order by 2,1;

comment on column public.trader.PM is 'Portfolio Manager (PM) manages traders';

comment on column public.trader.buying_power is 'Trader is authorized this buying power in each transaction';

commit;

Generate Billions of Trades

Now, we'll scale up our compute resources and generate billions of trades:

-- create billions of trades where action = buy

drop table if exists trade;

-- size up to save time since we are generating billions of trades

alter warehouse finservam_devops_wh set warehouse_size = 'xxlarge' wait_for_completion = TRUE enable_query_acceleration = true;

-- create billions of trades where action = buy

create or replace transient table trade

comment = 'trades made and cash used; unique_key: symbol, exchange, date'

as

select

c.*,

round(buying_power/close,0) num_shares,

close * round(buying_power/close,0) * -1 cash,

t.trader, t.PM

from

(

select

date, h.symbol, h.exchange, 'buy'::varchar(25) action, close

from stock_history h

where year(date) < 2021

) c

full outer join public.trader t

order by 8,2,1; -- Trader, symbol, date

-- create billions of trades where action = hold

insert into trade

select

c.*,

0 num_shares,

0 cash,

t.trader, t.PM

from

(

select

date, h.symbol, h.exchange, 'hold'::varchar(25) action, close

from stock_history h

where year(date) >= 2021

) c

full outer join public.trader t

order by 8,2,1; -- Trader, symbol, date

-- Size down to immediately save credits

alter warehouse finservam_devops_wh suspend;

alter warehouse finservam_devops_wh set warehouse_size = 'xsmall';

Create Cluster Key and Position View

Finally, we'll optimize our table with a cluster key and create a view for position calculations:

-- Create clustered key based on what we sorted

alter table trade cluster by (trader, symbol, date);

-- Cluster_by column

show tables like 'trade';

-- Common-Table Expressions (CTEs) and window functions for real-time number of stock shares, cash used, and Profit and Loss

create or replace view public.position

(

symbol, exchange, date, trader, pm, num_shares_cumulative, cash_cumulative, close, market_value,

PnL comment 'Profit and Loss: Demonstrate comment on view column'

)

comment = 'what assets owned; demo Window Function running sum'

as

with cte as

(

select

t.symbol, t.exchange, t.date, trader, pm,

Sum(num_shares) OVER(partition BY t.symbol, t.exchange, trader ORDER BY t.date rows UNBOUNDED PRECEDING ) num_shares_cumulative,

Sum(cash) OVER(partition BY t.symbol, t.exchange, trader ORDER BY t.date rows UNBOUNDED PRECEDING ) cash_cumulative,

s.close

from public.trade t

inner join public.stock_history s on t.symbol = s.symbol and s.date = t.date

)

select

*,

num_shares_cumulative * close as market_value,

(num_shares_cumulative * close) + cash_cumulative as PnL

from cte;

-- Business_date function to get current date used by the business

CREATE or replace FUNCTION business_date()

RETURNS date

MEMOIZABLE

AS

$$

select max(date) dt from public.trade

$$;

Run the entire worksheet. Note that generating 3 billion trades will take approximately 5 minutes with an XXLarge warehouse.

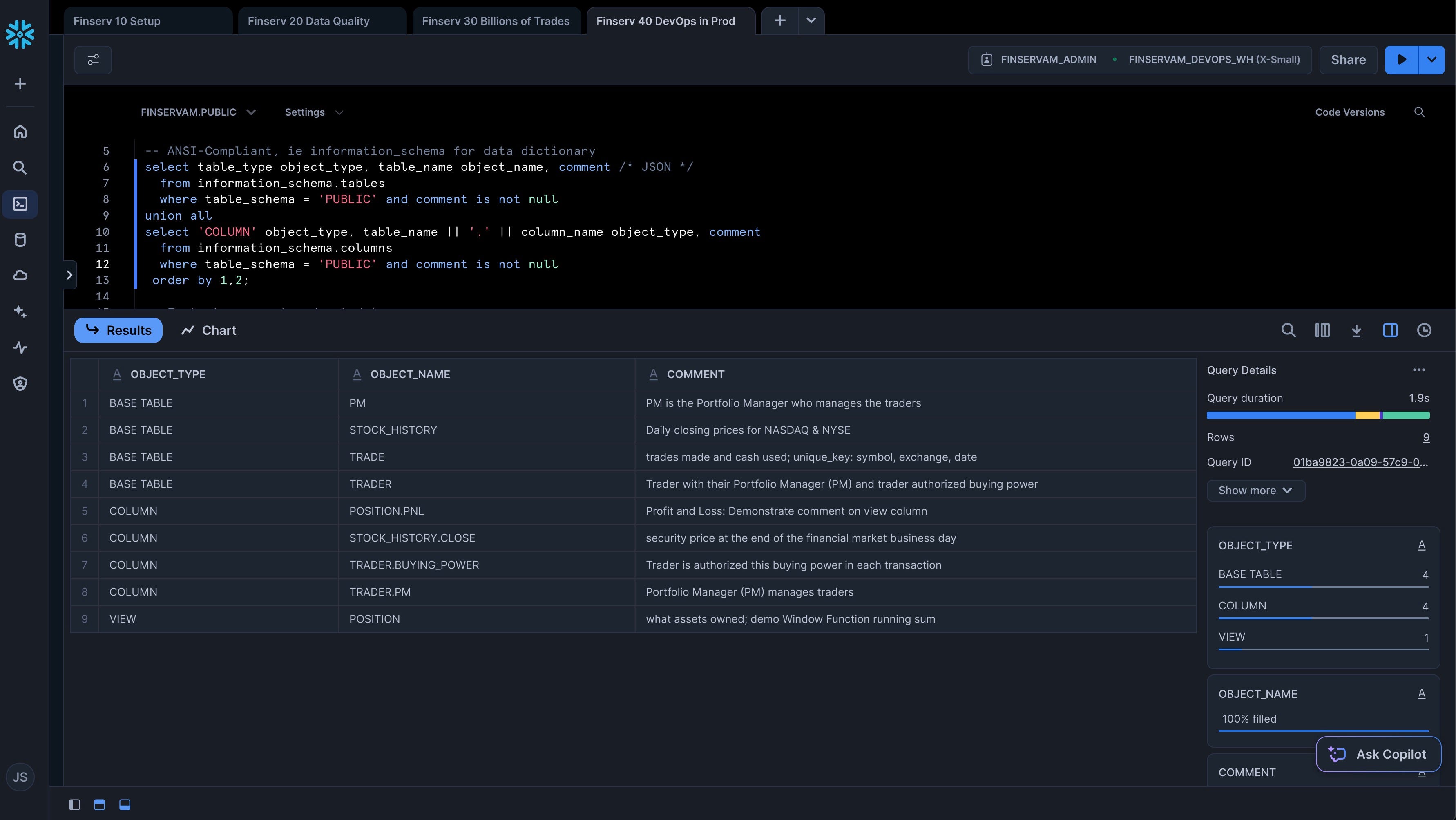

Create the DevOps Worksheet

- Create a new SQL Worksheet named "Finserv 40 DevOps in Prod"

- Copy and paste the following SQL to demonstrate ANSI-SQL compliance and instant row counts:

-- Context

use role finservam_admin; use warehouse finservam_devops_wh; use schema finservam.public;

alter warehouse finservam_devops_wh set warehouse_size = 'xsmall';

-- ANSI-Compliant, ie information_schema for data dictionary

select table_type object_type, table_name object_name, comment /* JSON */

from information_schema.tables

where table_schema = 'PUBLIC' and comment is not null

union all

select 'COLUMN' object_type, table_name || '.' || column_name object_type, comment

from information_schema.columns

where table_schema = 'PUBLIC' and comment is not null

order by 1,2;

-- Instant rowcount and metadata

show tables like 'trade';

-- Let's format that rowcount

set q = last_query_id();

select "rows", TO_VARCHAR("rows", '999,999,999,999') "pretty_rowcount" from table(result_scan($q));

Test Queries and Caching

Add the following SQL to test queries against a random trader and demonstrate Snowflake's caching capabilities:

-- Test against a random trader

set trader = (select top 1 trader from trader sample(1) where trader is not null);

-- Trade - date and quantity of buy, sell, or hold action on assets

select *

from trade

where trader = $trader and symbol = 'CMG'

order by date;

-- Notice the Solid State Drive (SSD cache) by running this query and - before the Virtual Warehouse suspends - rerun the query but change the date to something after your original date filter. [Because that data is already in the Compute layer's memory, it doesnt need to pull it from the micro-partitions again].

select *

from trade

where trader = $trader and symbol = 'SNOW' and action = 'buy' and date >= '2020-10-01'

order by date;

-- Window functions so we only pay storage for trade table while getting real-time calculations

select get_ddl('view','position');

-- Time-series: what are my real-time trades, cash, and PnL?

-- Notice query results cache on 2nd execution

select symbol, date, trader, cash_cumulative, num_shares_cumulative, close, market_value, PnL

from position where symbol = 'COST' and trader = $trader

order by date;

-- Metadata cache for count, min, max, etc

select count(*) from trade;

-- Python Faker: ie verify English & Chinese Synthetic names

select fake_py('en_US','name',null)::varchar as FAKE_NAME from table(generator(rowcount => 10));

select fake_py('zh_CN','name',null)::varchar as FAKE_NAME from table(generator(rowcount => 10));

-- Cross-Database Joins

select *

from Snow_Finance_Share.PUBLIC_DATA_FREE.stock_price_timeseries s

inner join finservam.public.stock_history h on s.ticker = h.symbol and h.date = s.date

where s.ticker = 'SNOW' and s.variable = 'post-market_close' and s.date = business_date();

DevOps Features

Finally, add the following SQL to demonstrate DevOps features like zero-copy cloning, time travel, and undrop:

-- Zero Copy Clone for instant dev,qa,uat sandboxes and backups

use role sysadmin;

drop database if exists finservam_dev;

create database finservam_dev clone finservam;

grant ownership on database finservam_dev to role finservam_admin;

use role finservam_admin;

-- Clones are zero additional storage cost; storage cost is only on deltas;

-- ie if you have 10 TB in prod but change only 1 TB in your clone, you only pay for 11 automatically compressed TBs

select *

from finservam.public.trade

where trader = $trader and symbol = 'COST';

-- We can change clones without impacting production

select *

from finservam_dev.public.trade

where trader = $trader and symbol = 'COST';

update finservam_dev.public.trade

set symbol = 'CMG'

where trader = $trader and symbol = 'COST';

-- We use Time Travel for DevOps & Rollbacks [configurable from 0–90 days]

set queryID = last_query_id();

-- Currently Costco doesn't exist

select *

from finservam_dev.public.trade

where trader = $trader and symbol = 'COST';

-- But we can Time Travel to see before the (DML) delete

select *

from finservam_dev.public.trade

before (statement => $queryid)

where trader = $trader and symbol = 'COST';

-- Roll back our our change

insert into finservam_dev.public.trade

select *

from finservam_dev.public.trade

before (statement => $queryid)

where trader = $trader and symbol = 'COST';

-- Undrop is also up to 90 days of Time Travel; DBAs and Release Managers sleep much better than backup & restore

drop table finservam_dev.public.trade;

-- Uncomment this and watch it fail

-- select count(*) from finservam_dev.public.trade;

-- But we can undrop for the time travel that we have set

undrop table finservam_dev.public.trade;

-- We can also undrop databases

drop database if exists finservam_dev;

show databases like 'finserv%';

-- Notice temporary escalation of privileges in RBAC model

use role accountadmin;

undrop database finservam_dev;

use role finservam_admin;

show databases like 'finserv%';

-- Let's not wait for auto-suspend

alter warehouse finservam_devops_wh suspend;

use schema finservam.public;

Run the entire worksheet to demonstrate these features.

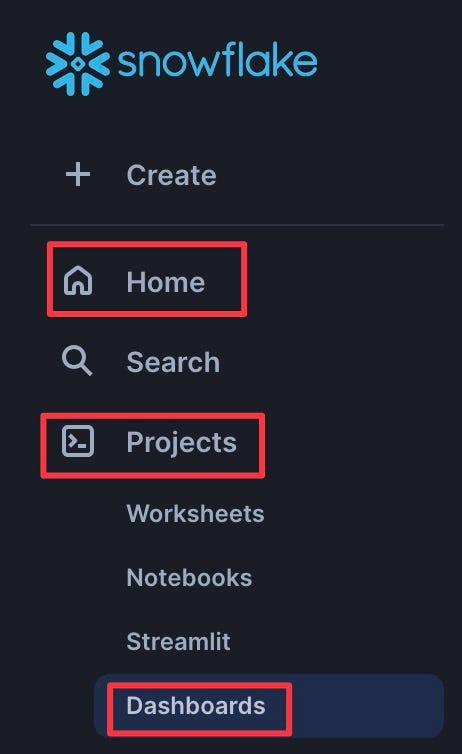

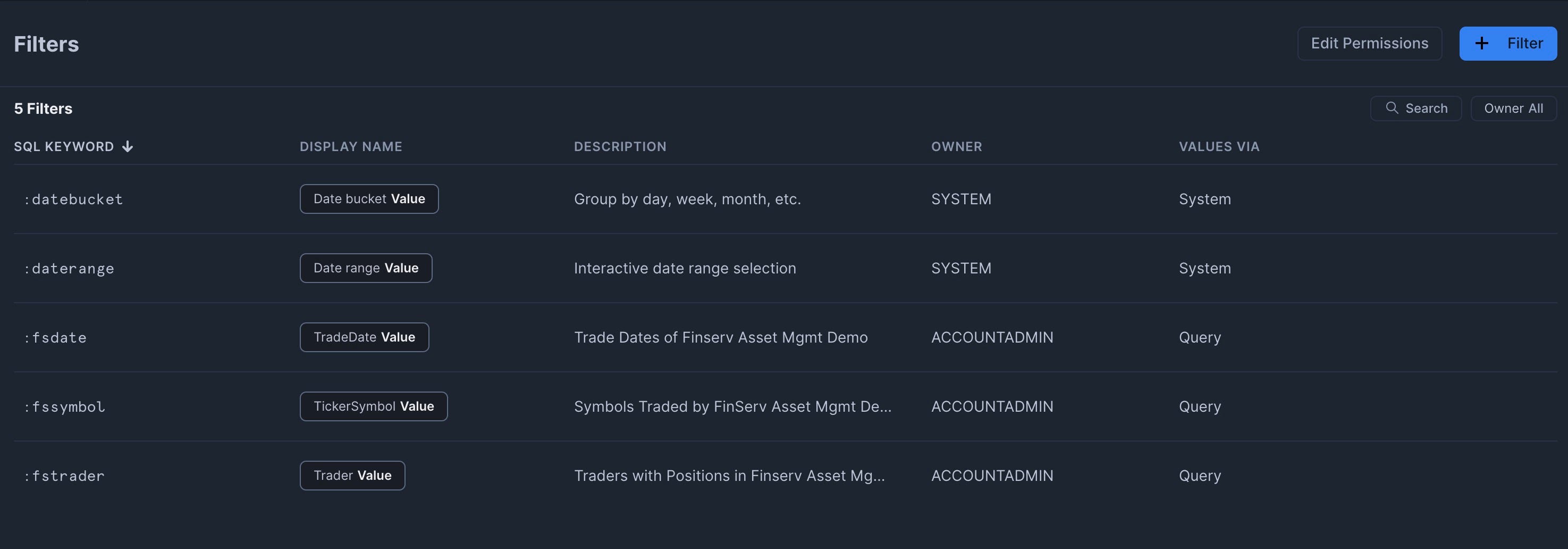

Now we'll create filters for our dashboard:

- Navigate to Dashboards from the left sidebar (Home | Projects | Dashboards)

- Click the Ellipsis in the top right and select "Manage Filters"

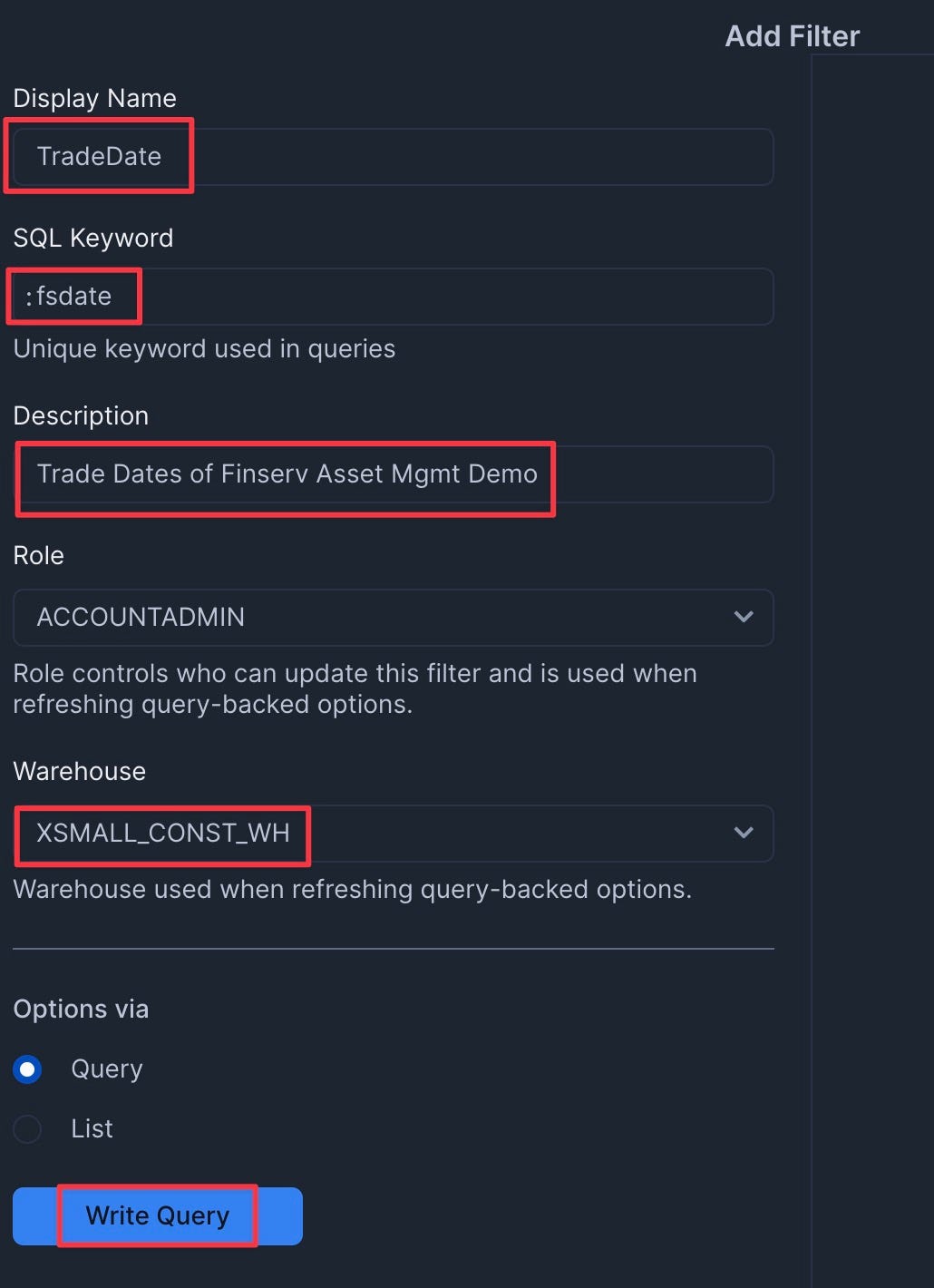

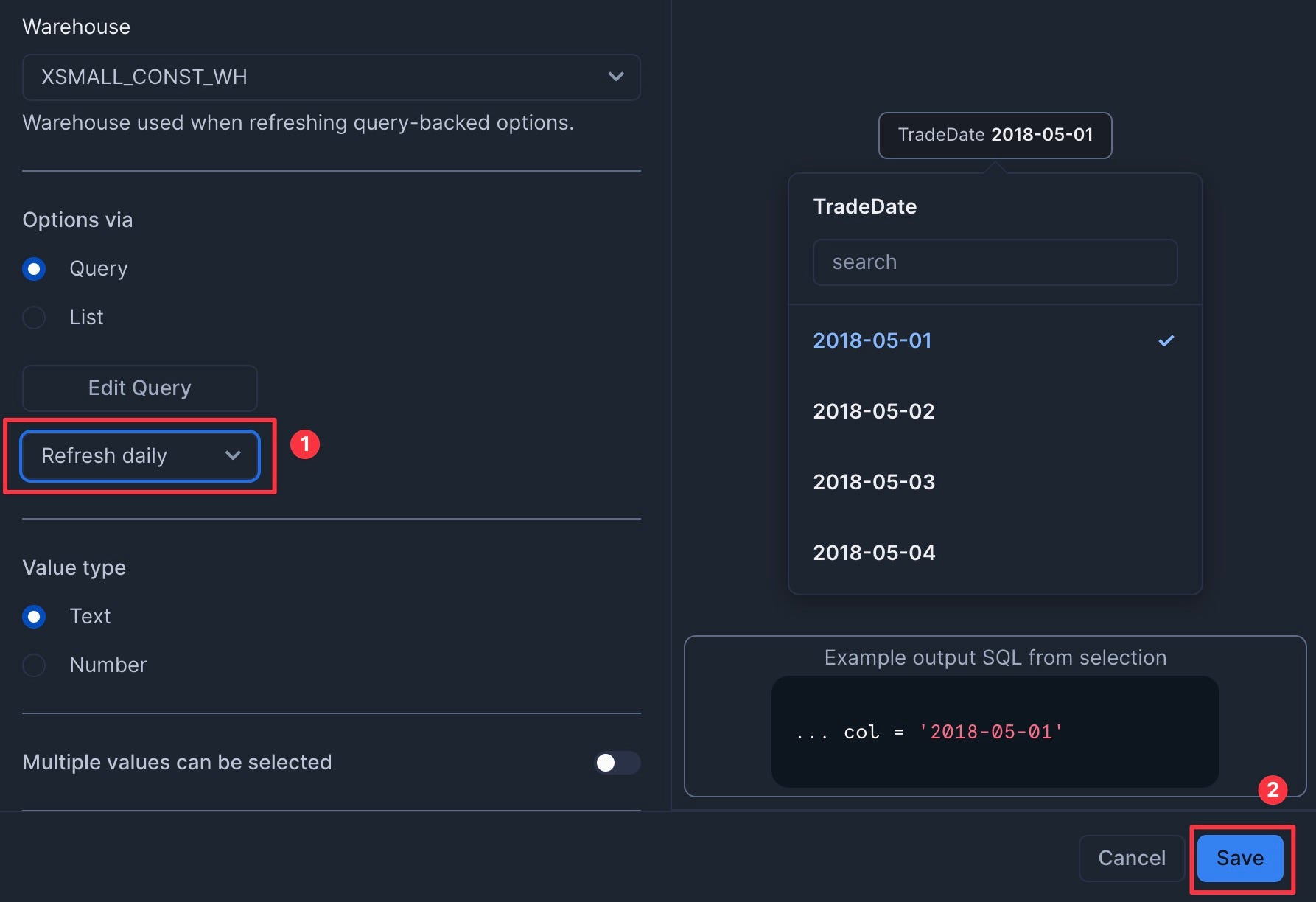

Add the TradeDate Filter

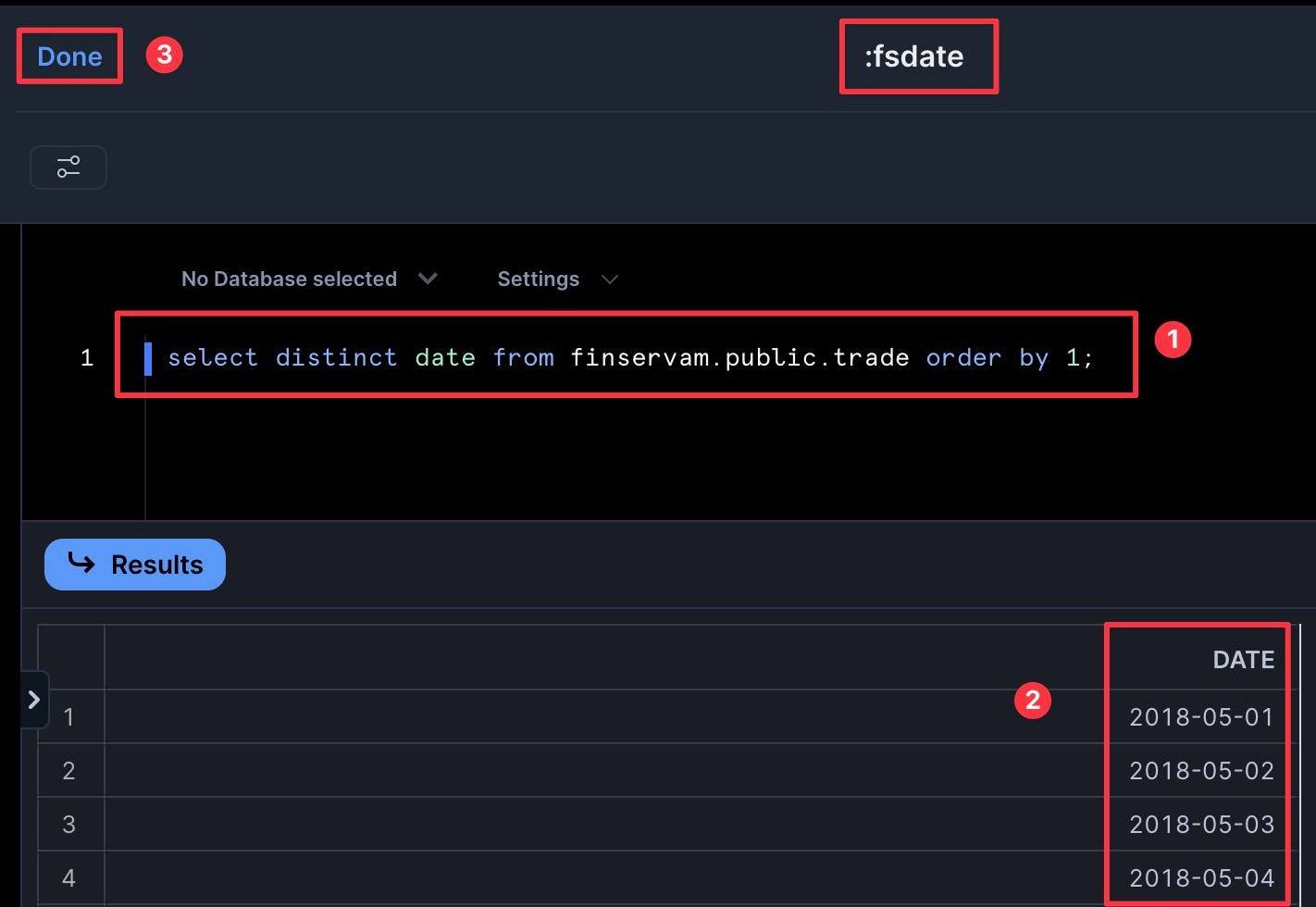

- Add a filter named "TradeDate" with the following settings:

- Type: Date Range

- SQL Query:

select distinct date from finservam.public.trade order by 1; - Set to refresh daily to save credits. Then click Save.

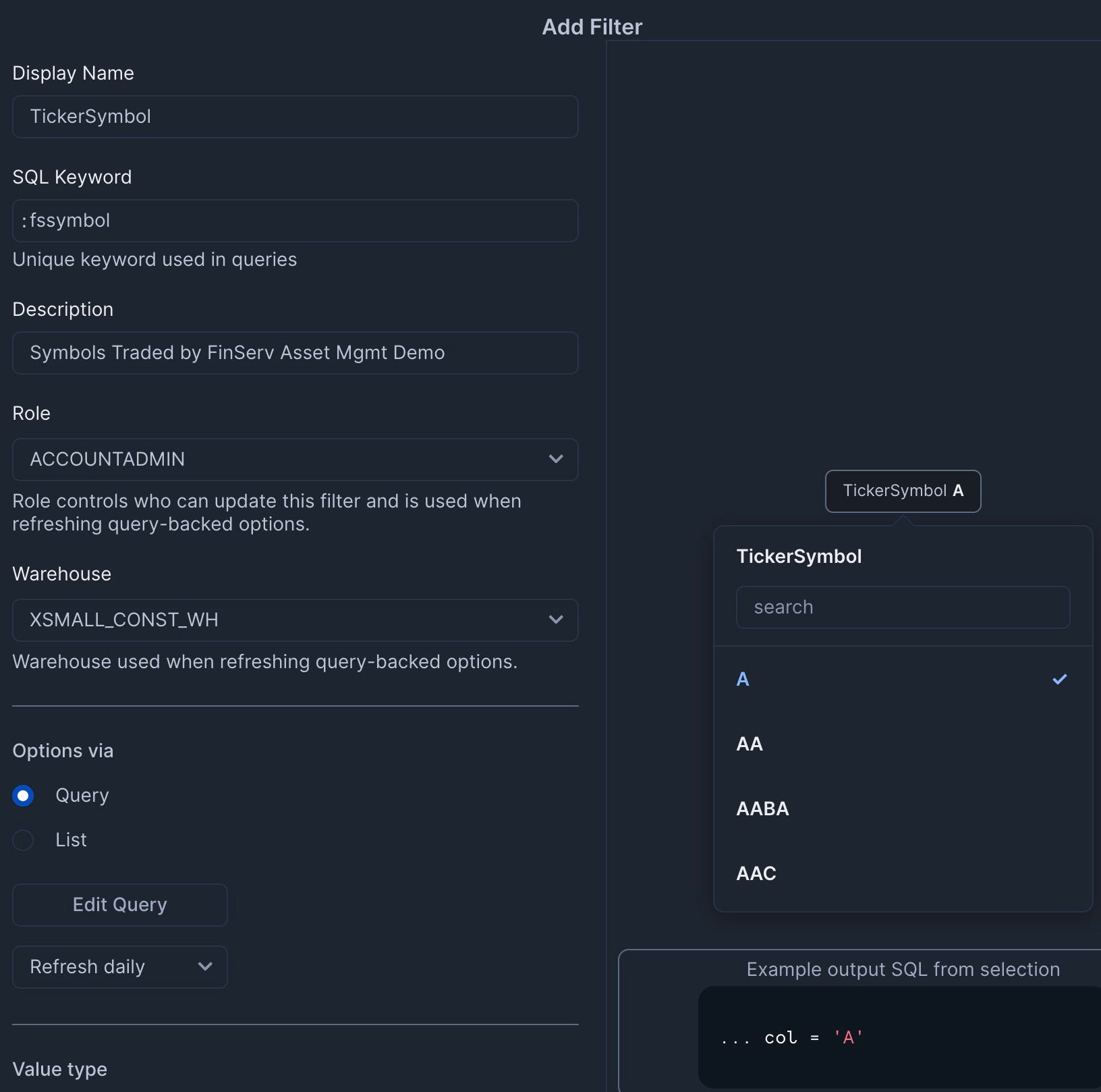

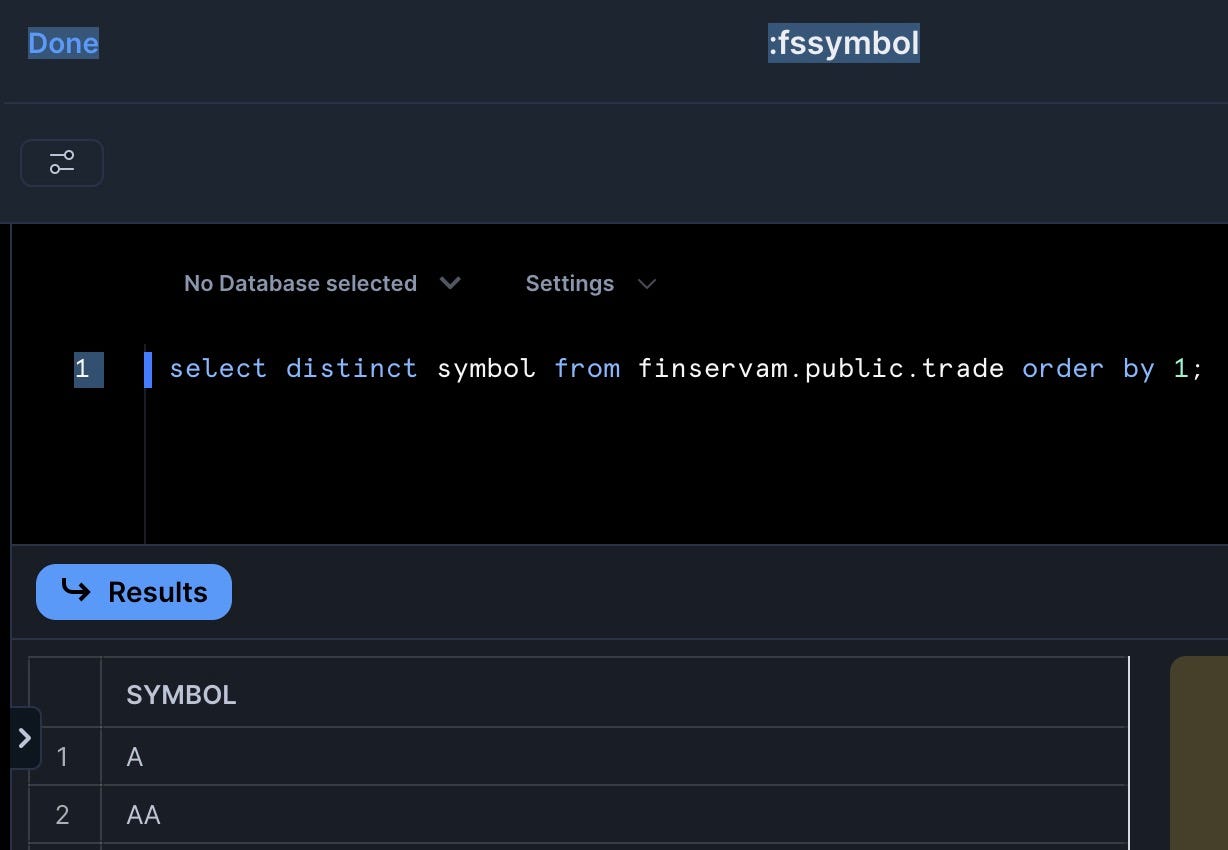

Add the TickerSymbol Filter

- Add a filter named "TickerSymbol" with the following settings:

- Type: Multi-select

- SQL Query:

select distinct symbol from finservam.public.trade order by 1; - Set to refresh daily

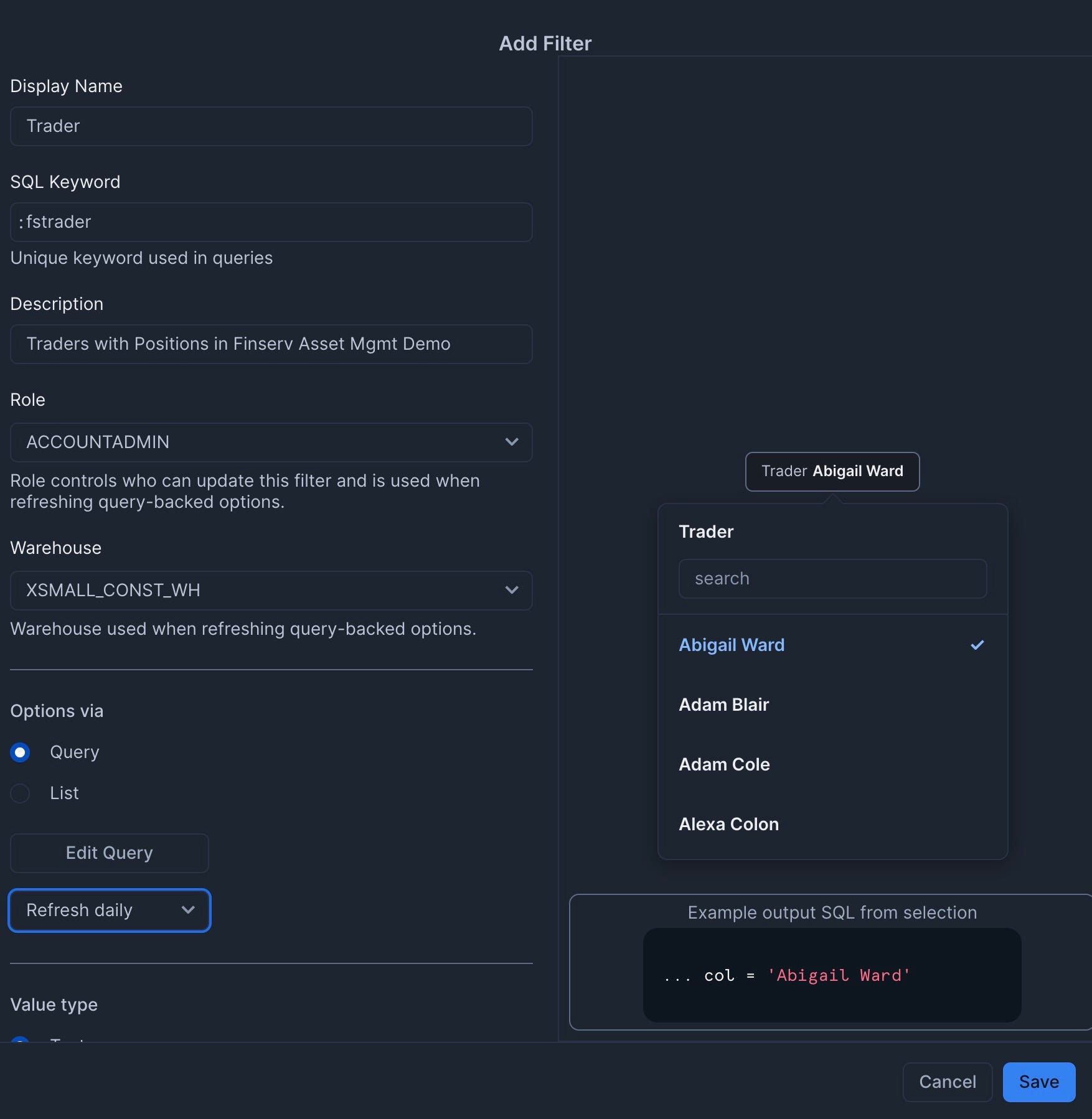

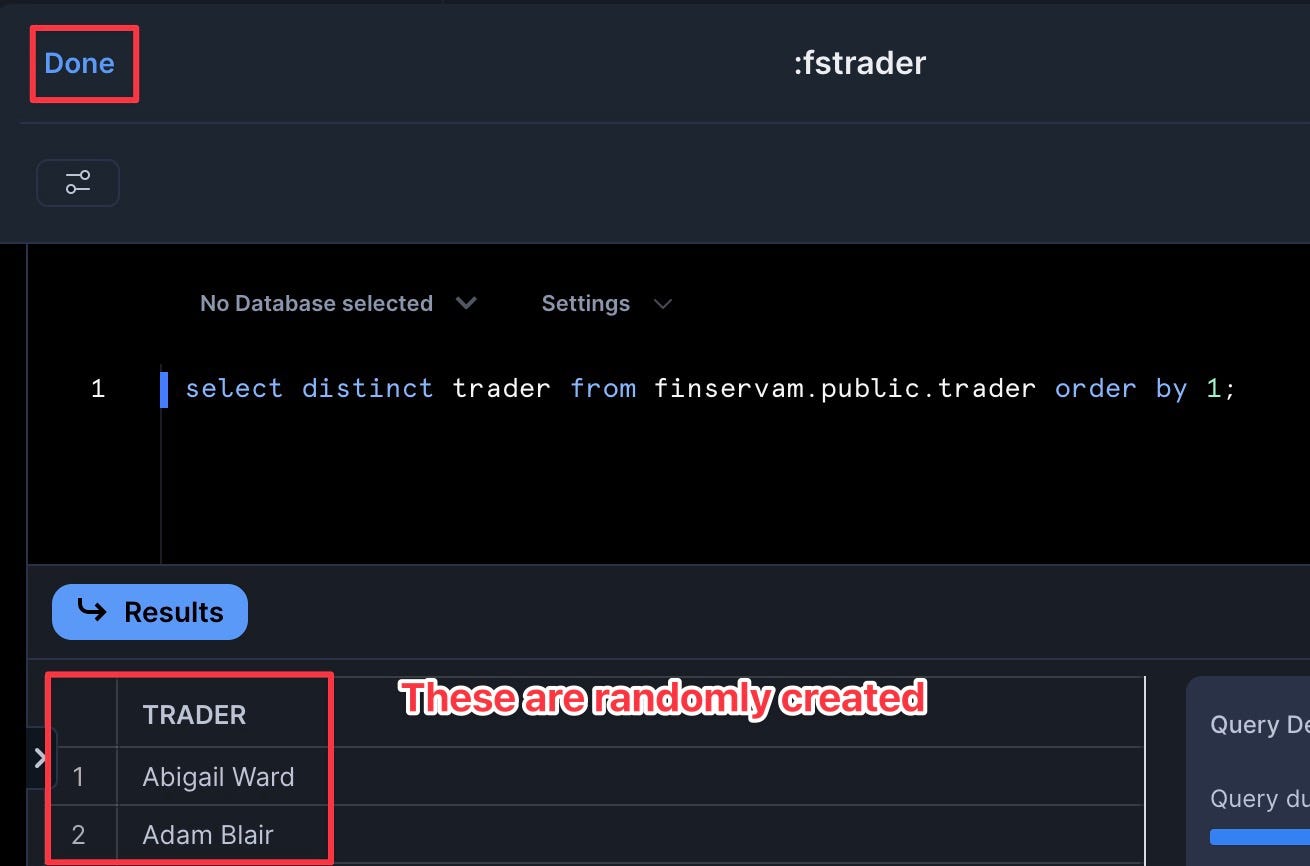

Add the Trader Filter

- Add a filter named "Trader" with the following settings:

- Type: Multi-select

- SQL Query:

select distinct trader from finservam.public.trader order by 1; - Set to refresh daily

When complete, you should have three custom filters plus the two Snowsight system filters.

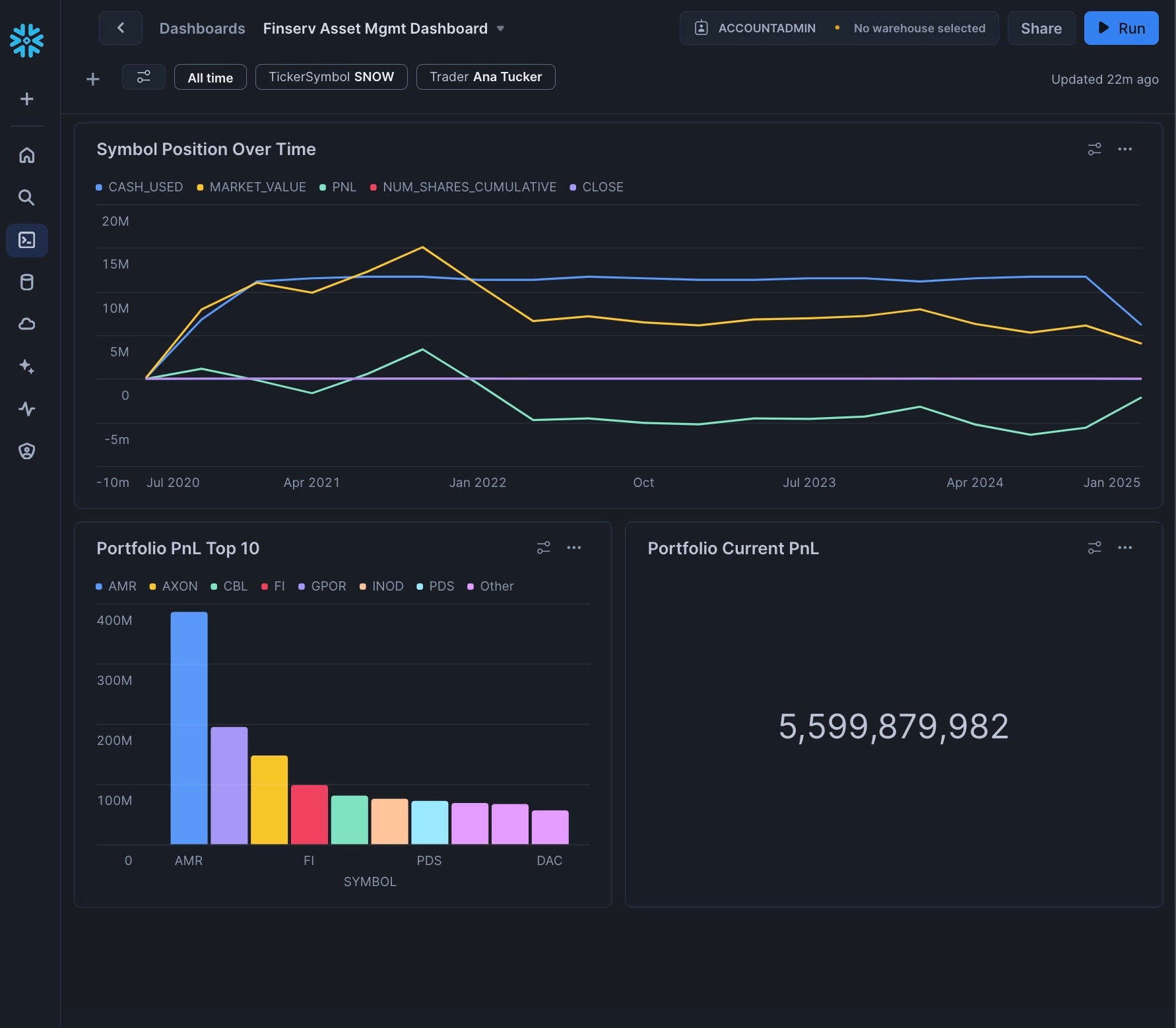

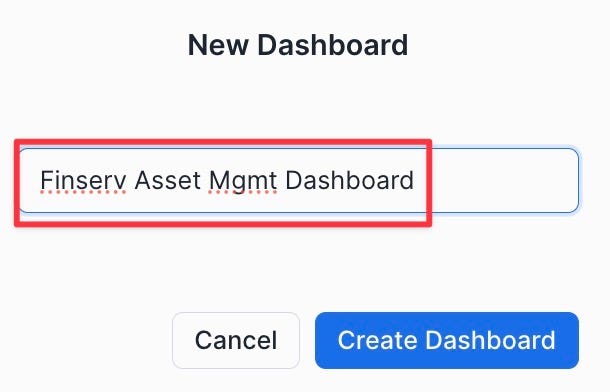

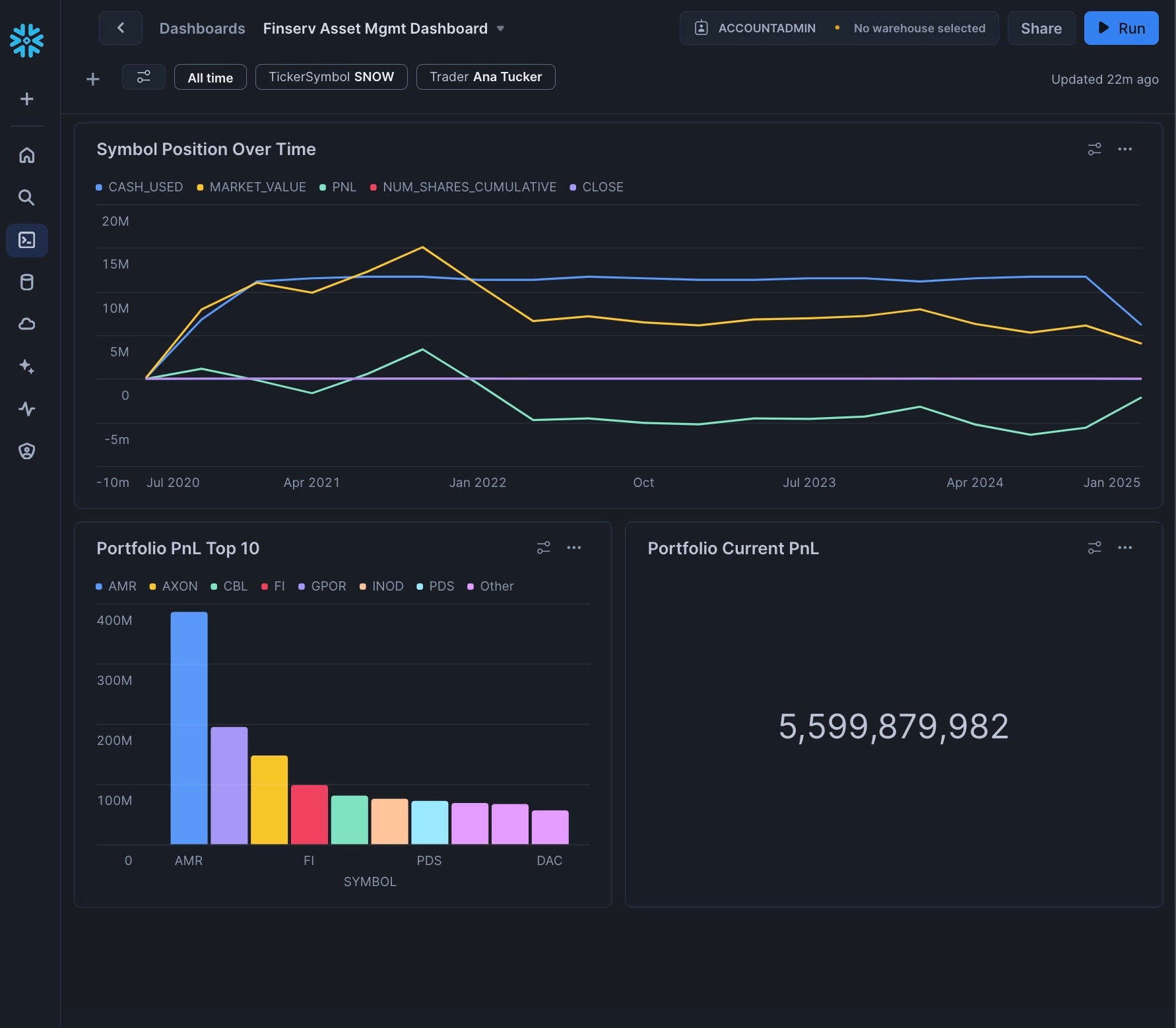

Now we'll create the dashboard with multiple tiles:

- Click the plus icon and select "Dashboard"

- Name it "Finserv Asset Mgmt Dashboard"

- Set the Role to "finservam_admin" and the Virtual Warehouse to "finservam_devops_wh"

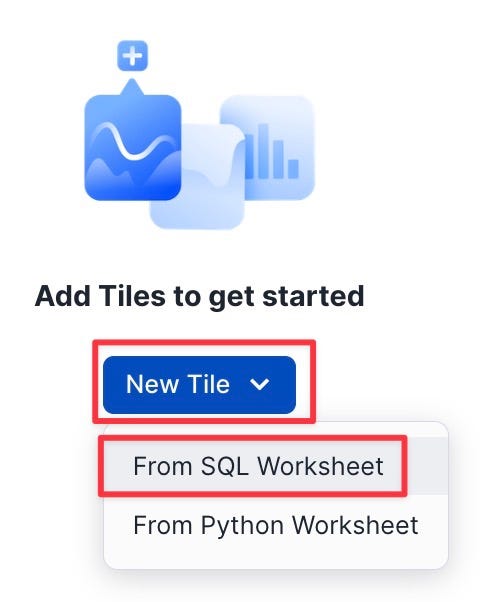

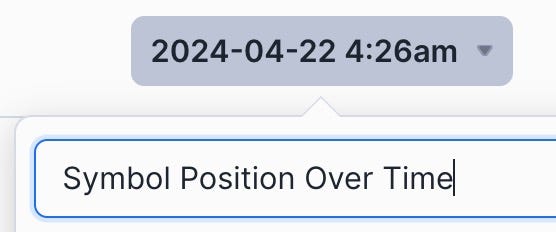

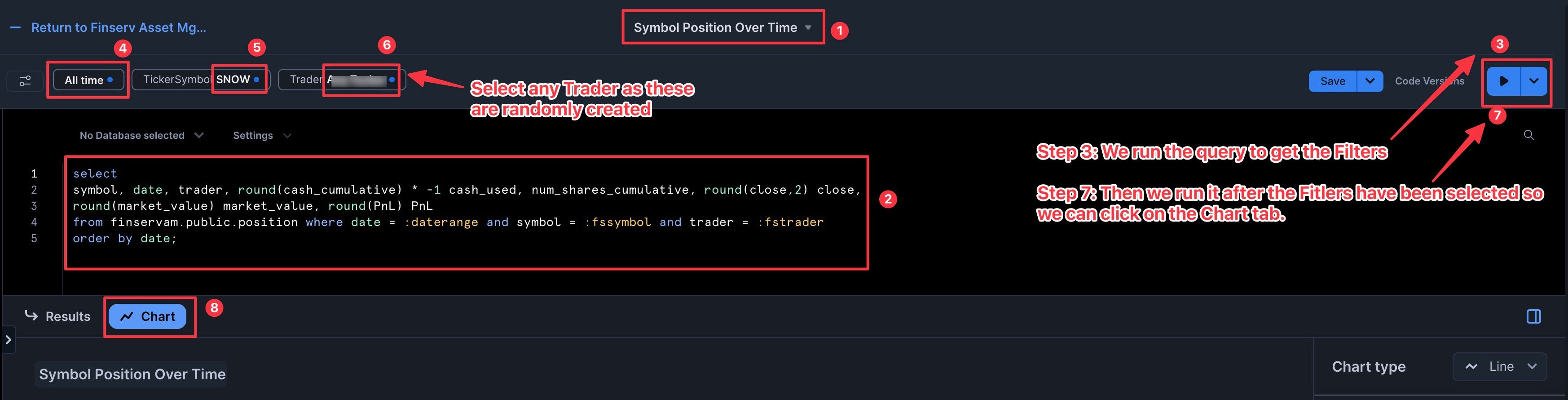

Add the Symbol Position Over Time Tile

- Click "Add Tile" | "From SQL Worksheet"

- Rename the tile to "Symbol Position Over Time"

- Add the following SQL:

select

symbol, date, trader, round(cash_cumulative) * -1 cash_used, num_shares_cumulative, round(close,2) close,

round(market_value) market_value, round(PnL) PnL

from finservam.public.position where date = :daterange and symbol = :fssymbol and trader = :fstrader

order by date;

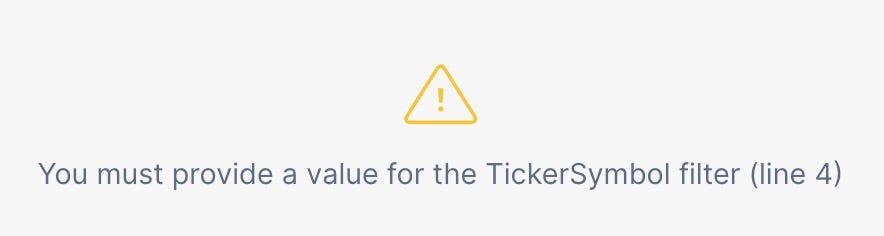

You'll get an expected error. This is good as it now exposes the filters — that we created in the prior step — for us:

- Set the DateRange, TickerSymbol, and Trader filters

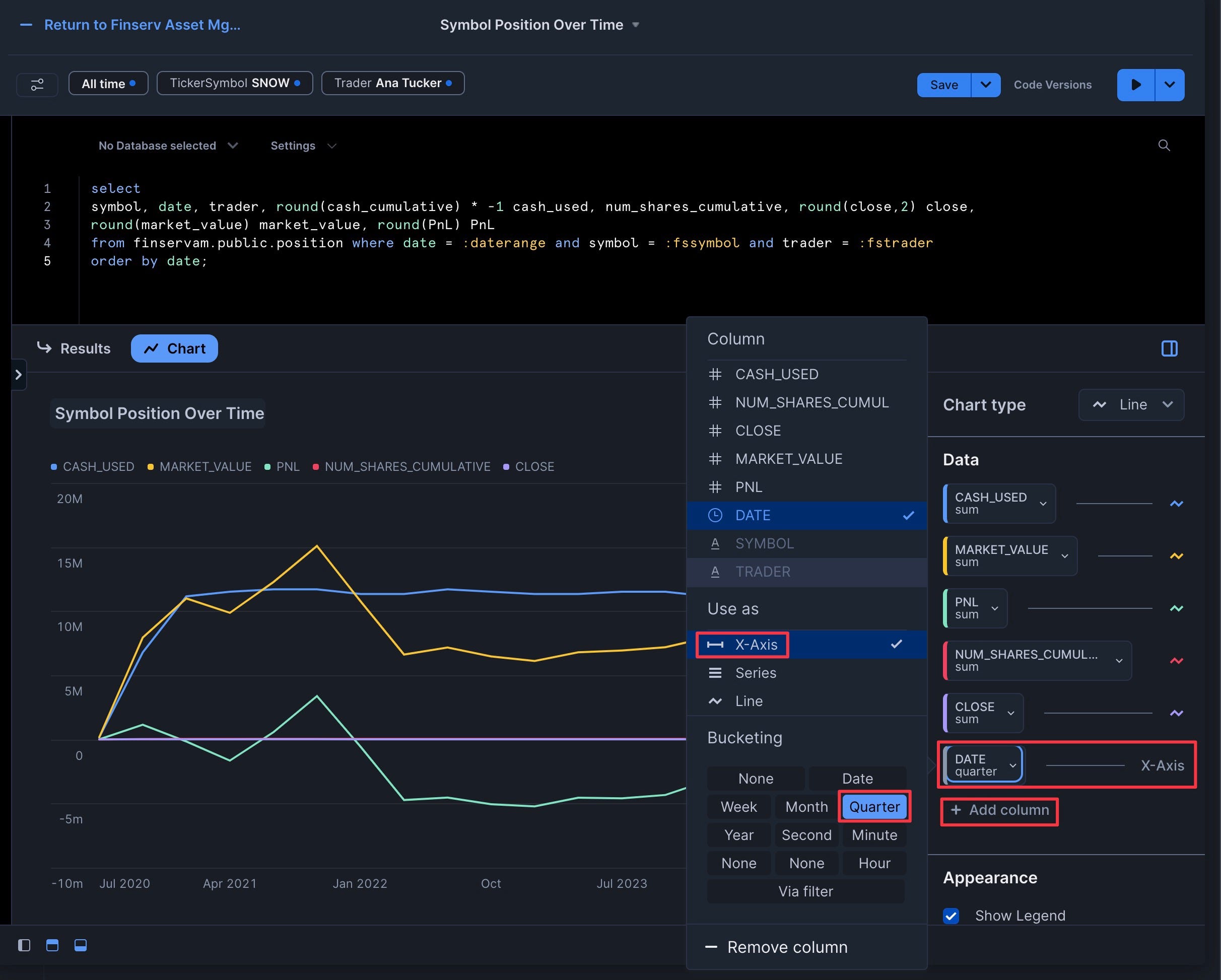

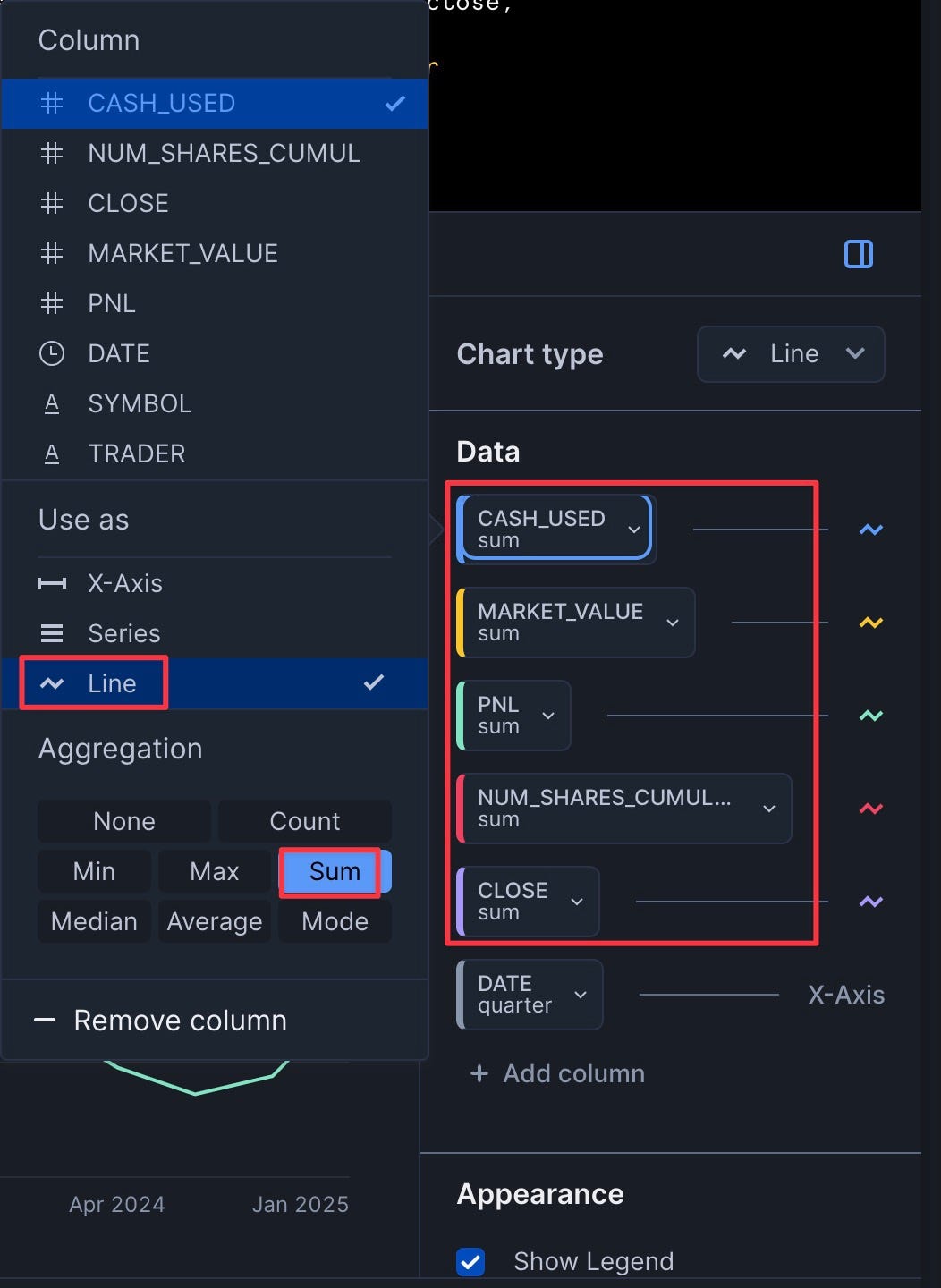

- Click "Chart" and add "Date" as the X-Axis with bucketing set to "Quarter"

- Add the five other columns (cash_used, num_shares_cumulative, close, market_value, PnL) with "Use As" set to "Line" and "Aggregation" set to "Sum"

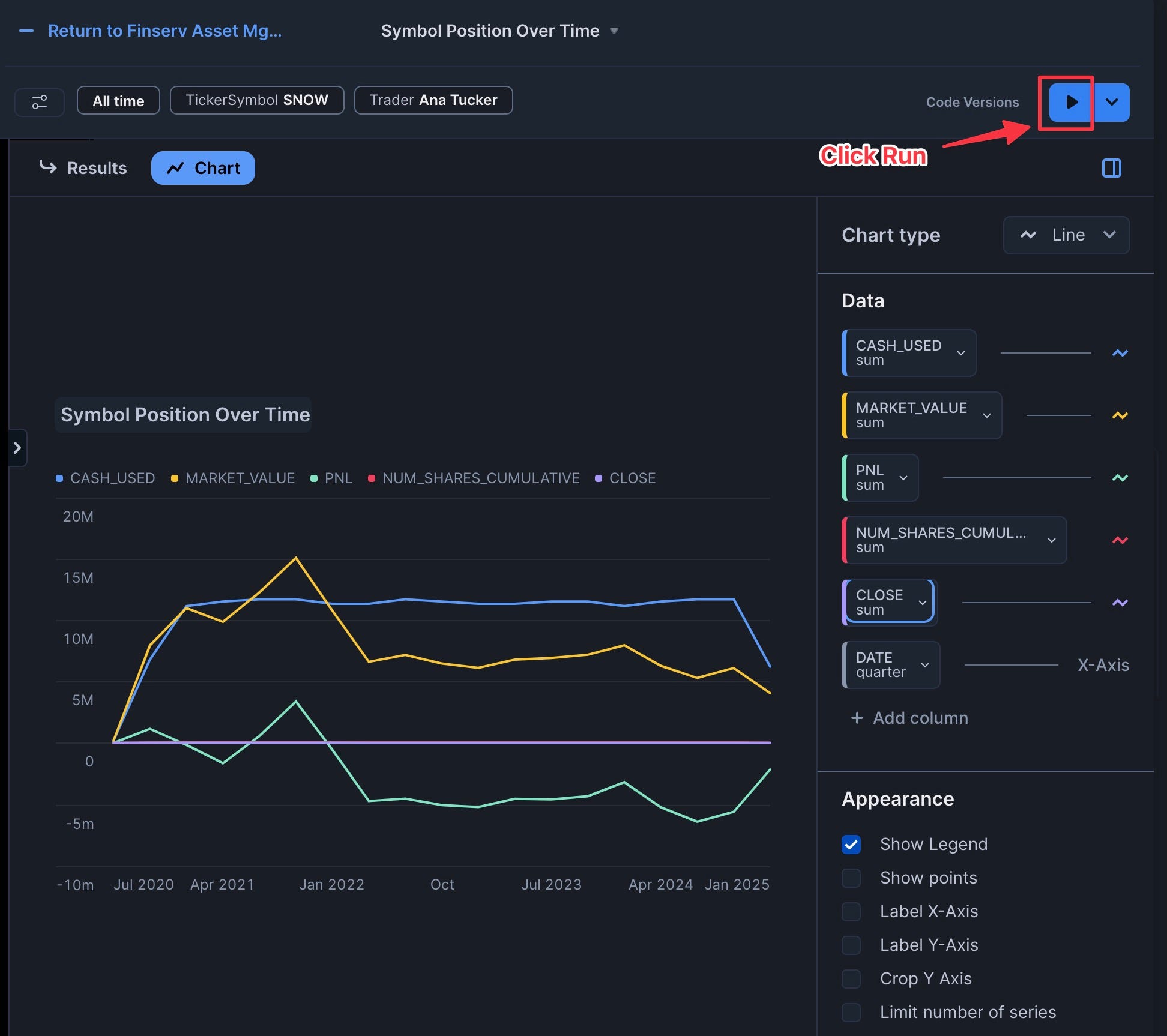

- Click "Run"

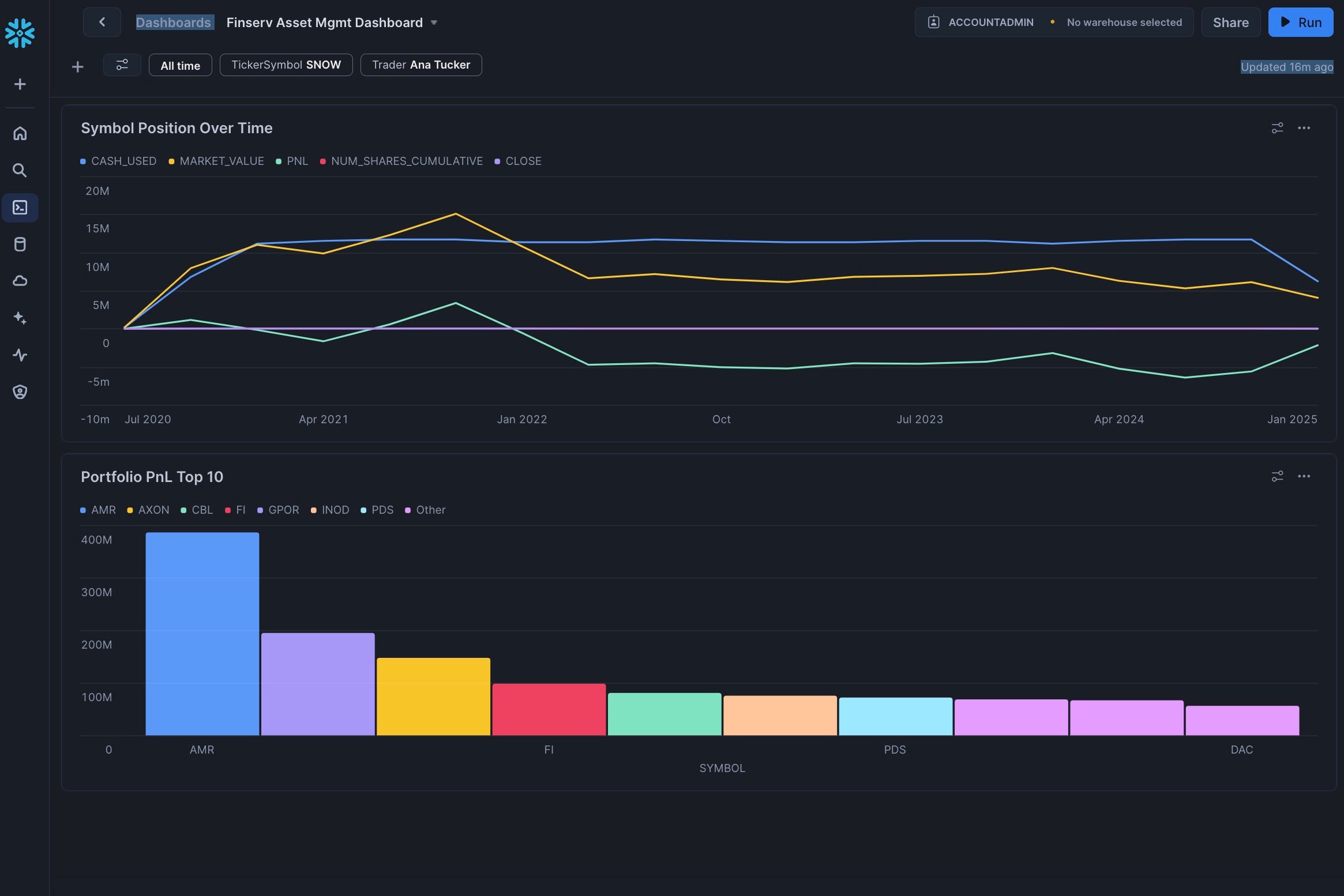

Congrats you have added your first Chart Tile:

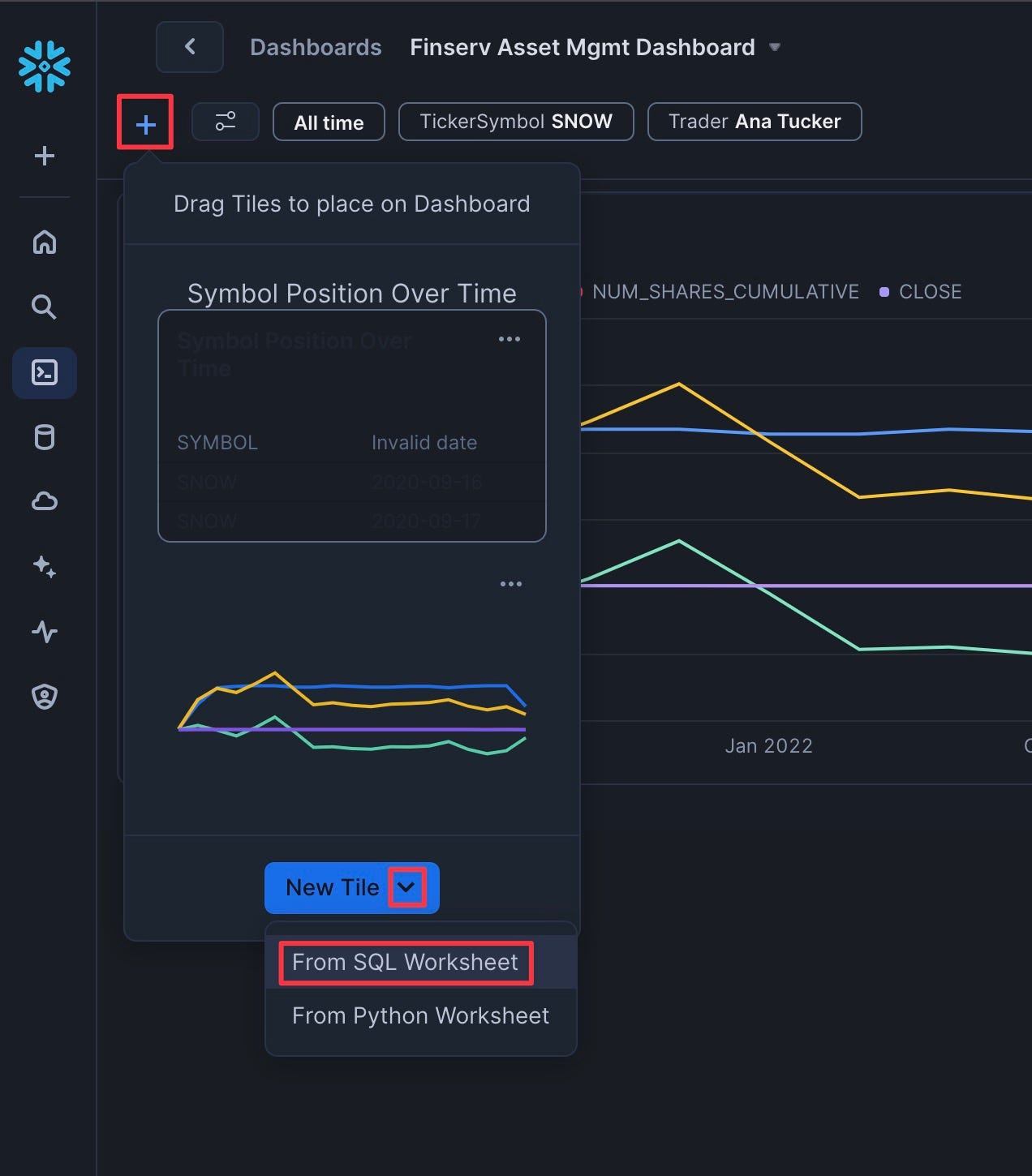

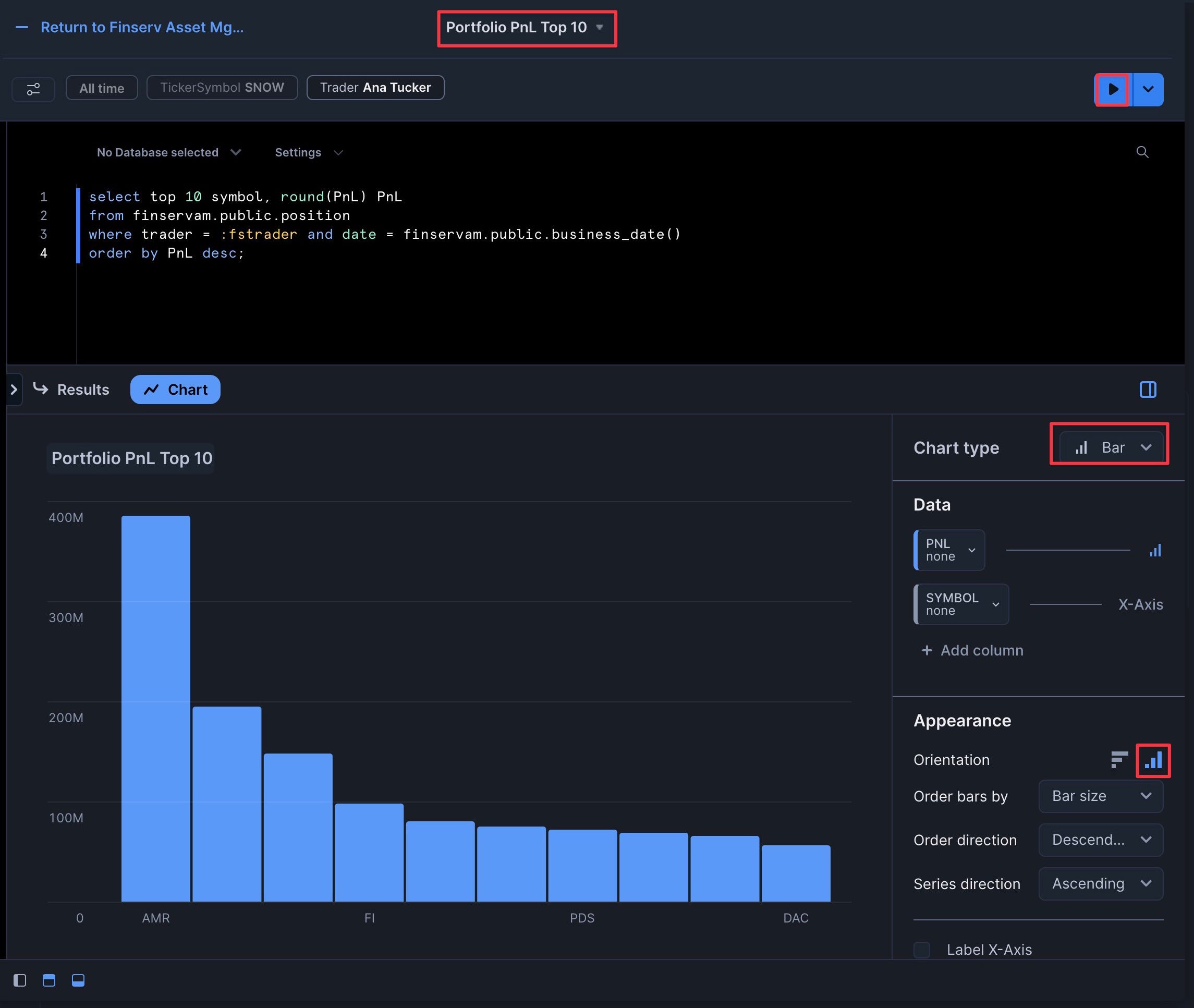

Add the Portfolio PnL Top 10 Tile

- Click "Plus" | "New Tile" | "From SQL Worksheet"

- Rename the tile to "Portfolio PnL Top 10"

- Add the following SQL:

select top 10 symbol, round(PnL) PnL

from finservam.public.position

where trader = :fstrader and date = finservam.public.business_date()

order by PnL desc;

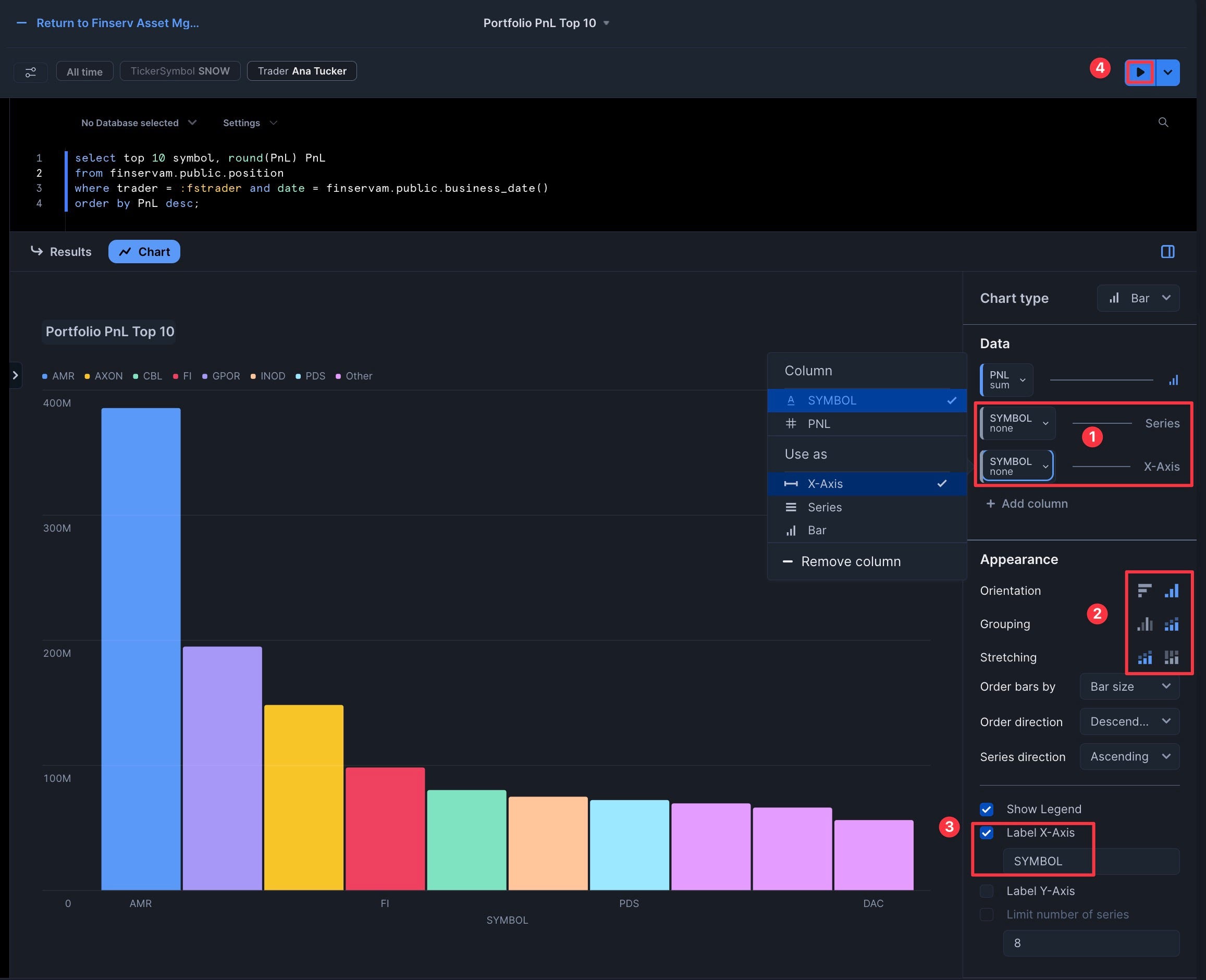

- Click "Chart" and ensure it's a "Bar" chart with "Vertical" appearance

- Add "Symbol" as both the "Series" and "X-Axis"

- Set "Grouping" to "Stacked" and leave "Stretching" as "No Stretching"

- Click "Label X-Axis" to add "SYMBOL"

- Click "Run"

- Click "Return" to go back to the dashboard

Congrats, you have 2 of the 4 tiles complete!

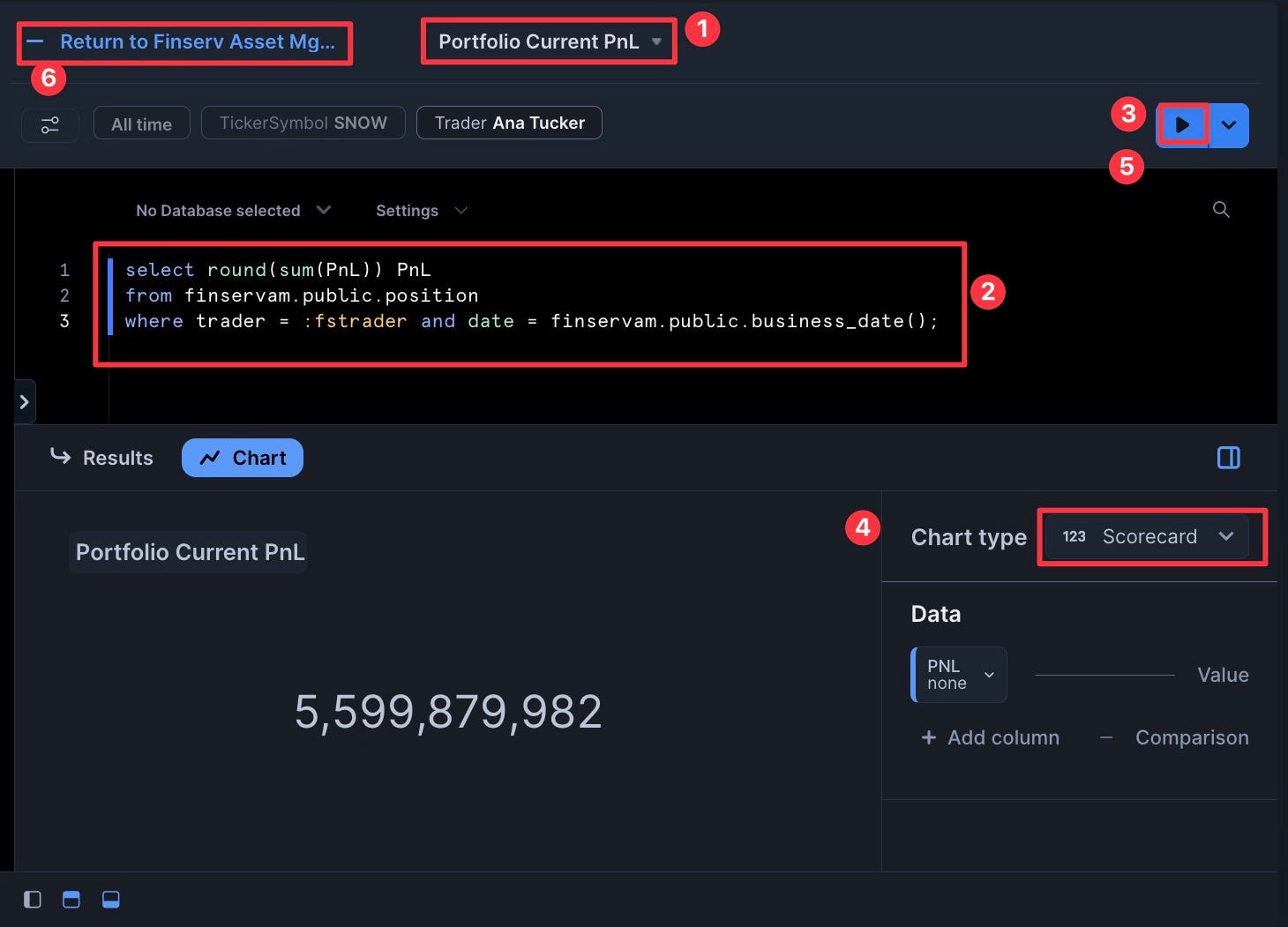

Add the Portfolio Current PnL Tile

- Add a "New Tile" and name it "Portfolio Current PnL"

- Add the following SQL:

select round(sum(PnL)) PnL

from finservam.public.position

where trader = :fstrader and date = finservam.public.business_date();

- Set the Chart type as "Scorecard"

- Click "Return" to go back to the dashboard

Congrats! You've created your dashboard! For extra credit: You can now drag and drop the tiles to arrange them as desired.

If you want to clean up all the objects created in this guide, you can create a new worksheet named "Finserv 90 reset" with the following SQL:

-- Optional Script to remove all objects created during this demo

-- You can name this worksheet: "Finserv 90 reset"

use role finservam_admin;

drop database if exists finservam;

drop database if exists finservam_dev;

drop warehouse if exists finservam_devops_wh;

use role accountadmin;

drop role if exists finservam_admin;

-- optional

-- drop database if exists Snow_Finance_Share;

-- drop warehouse if exists xsmall_const_wh;

-- Note: You can also drop the Dashboard and the Dashboard Filters

Congratulations! You've successfully built a Financial Services Asset Management demo in Snowflake that handles 3 billion synthetic trades while providing real-time cash and profit/loss calculations. You've learned how to scale compute resources up and down as needed, create interactive dashboards, and implement DevOps practices like zero-copy cloning and time travel.

What You Learned

- Queried free stock market history data without copying or moving data

- Created synthetic traders and billions of trades using Python and SQL

- Scaled compute resources up and down to optimize performance and cost

- Implemented cluster keys and auto-clustering for performance optimization

- Created interactive dashboards with filters for business users

- Used DevOps features like zero-copy cloning and time travel

Related Resources

Articles:

Documentation:

Additional Reading: